2026 Market Outlook and Major Themes

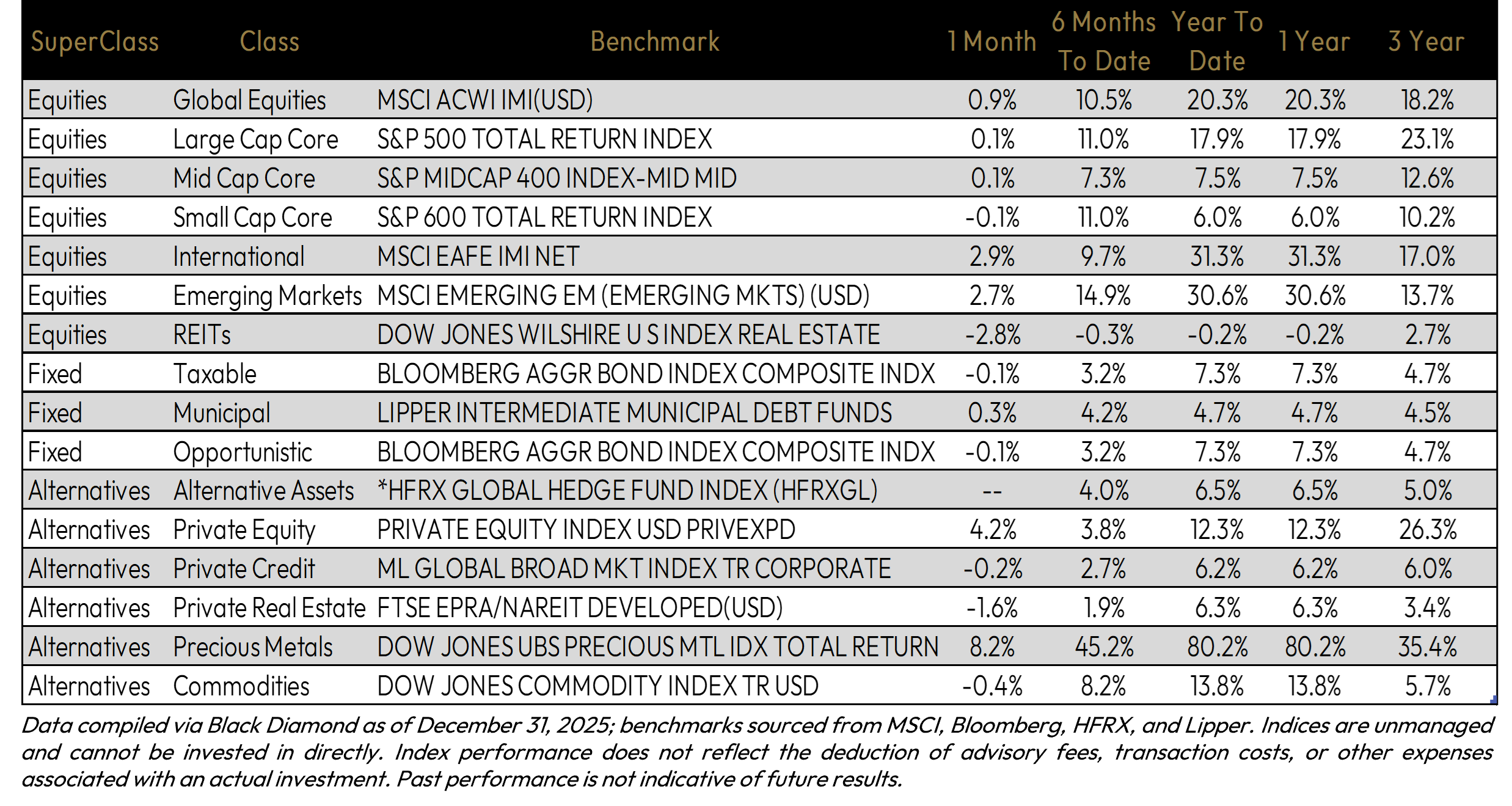

Overview of 2025 Market Performance

The U.S. equity market in 2025 can reasonably be characterized as a prolonged “climbing the wall of worry.” This outcome was broadly consistent with our views throughout the year, as markets transitioned from an early‑cycle bull phase following the early‑Q2 correction toward more mid‑cycle characteristics by year‑end. Despite periods of elevated volatility driven by trade policy developments and political friction, equity markets ultimately delivered a third consecutive year of solid double‑digit returns.

The Three Phases of Returns in 2025

Market performance during 2025 was highly uneven and unfolded in several distinct phases, rather than along a linear trajectory.

The Q2 Tariff Shock: After a relatively stable start to the year, markets experienced a sharp disruption in April following the announcement of broad‑based tariffs. The resulting selloff produced the largest single‑day decline since 2020, with the S&P 500 falling nearly 5% on April 3 and an additional 6% in the following session as trade‑related uncertainty intensified. A market bottom formed shortly thereafter when a 90‑day pause on tariffs was announced, after which global equity markets recovered meaningfully.

The Summer Recovery: Following the pause of the most aggressive tariff actions in mid‑April, markets entered a gradual recovery phase. Economic activity slowed but remained resilient, and ongoing capital expenditures related to artificial intelligence served as an important stabilizing force.

The Year‑End Advance: Equity markets regained momentum in the fourth quarter, supported by stronger‑than‑expected third‑quarter GDP growth of 4.3% annualized and improving sentiment around year‑end earnings. By December, the S&P 500 reached record levels, briefly exceeding 6,900.

Market resilience was further supported by Federal Reserve policy actions and a bifurcated, yet steady, consumer backdrop. Despite visible public tension between the White House and Federal Reserve leadership, the central bank’s decision to implement three interest‑rate cuts during the second half of the year provided a supportive environment for fixed income markets and helped alleviate valuation pressures in equities. By year‑end, economic growth had reached its strongest pace in two years, suggesting that the U.S. consumer remained capable of absorbing elevated costs and policy uncertainty, at least in the near term.

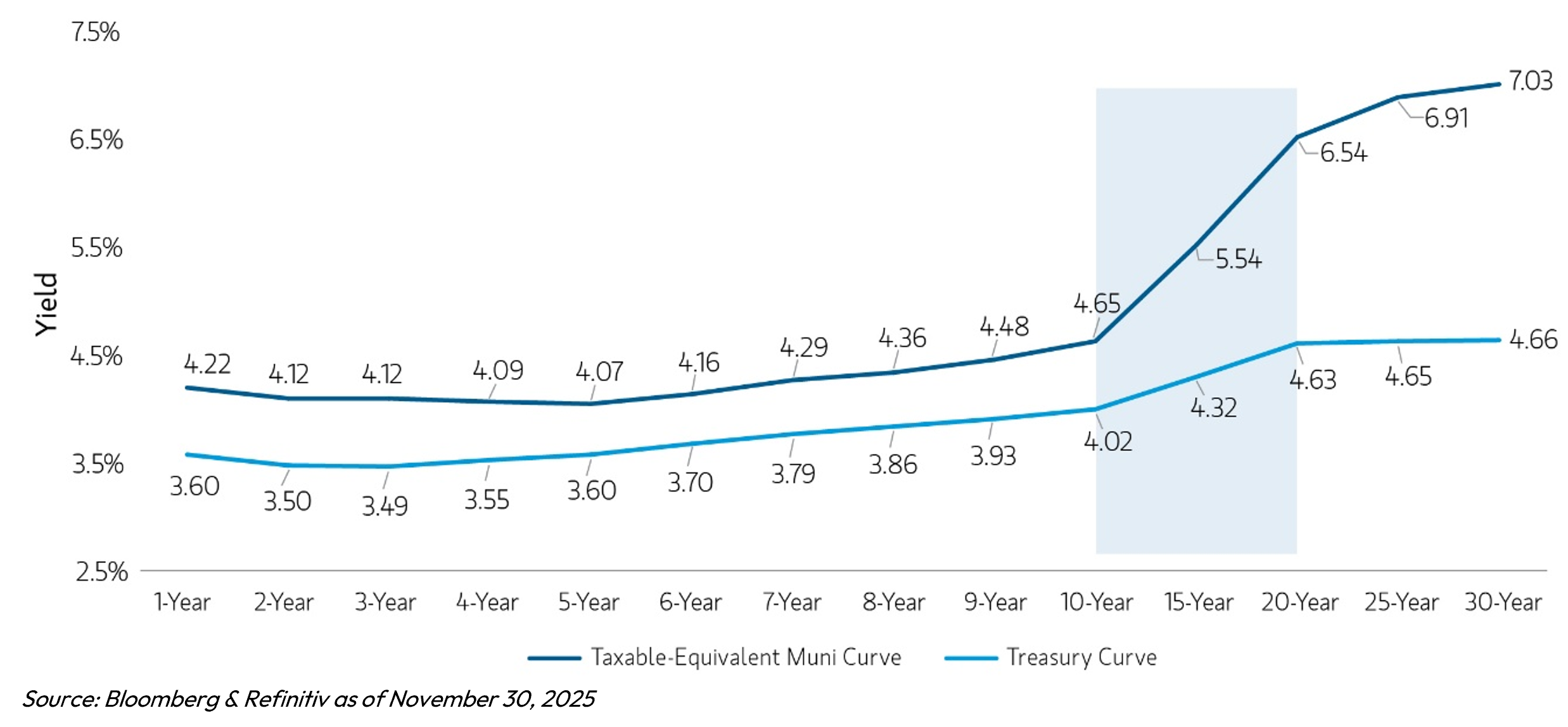

Fixed Income

Fixed income delivered modest but stabilizing returns in 2025, serving its intended role as a ballast amid periodic equity volatility. Taxable bonds generated mid-single-digit gains for the year, supported by easing inflation pressures and a Federal Reserve that ultimately pivoted toward rate cuts in the second half of the year. Municipal bonds posted similar positive returns, benefiting from both rate relief and continued demand for tax-advantaged income. Opportunistic fixed income strategies tracked broadly in line with core bonds, reflecting a year in which income, rather than capital appreciation, were the primary drivers of performance in this fixed income component. Overall, fixed income rewarded investors who maintained duration exposure and emphasized current income, while reinforcing its value as a diversification tool rather than a return maximizer.

Alternatives

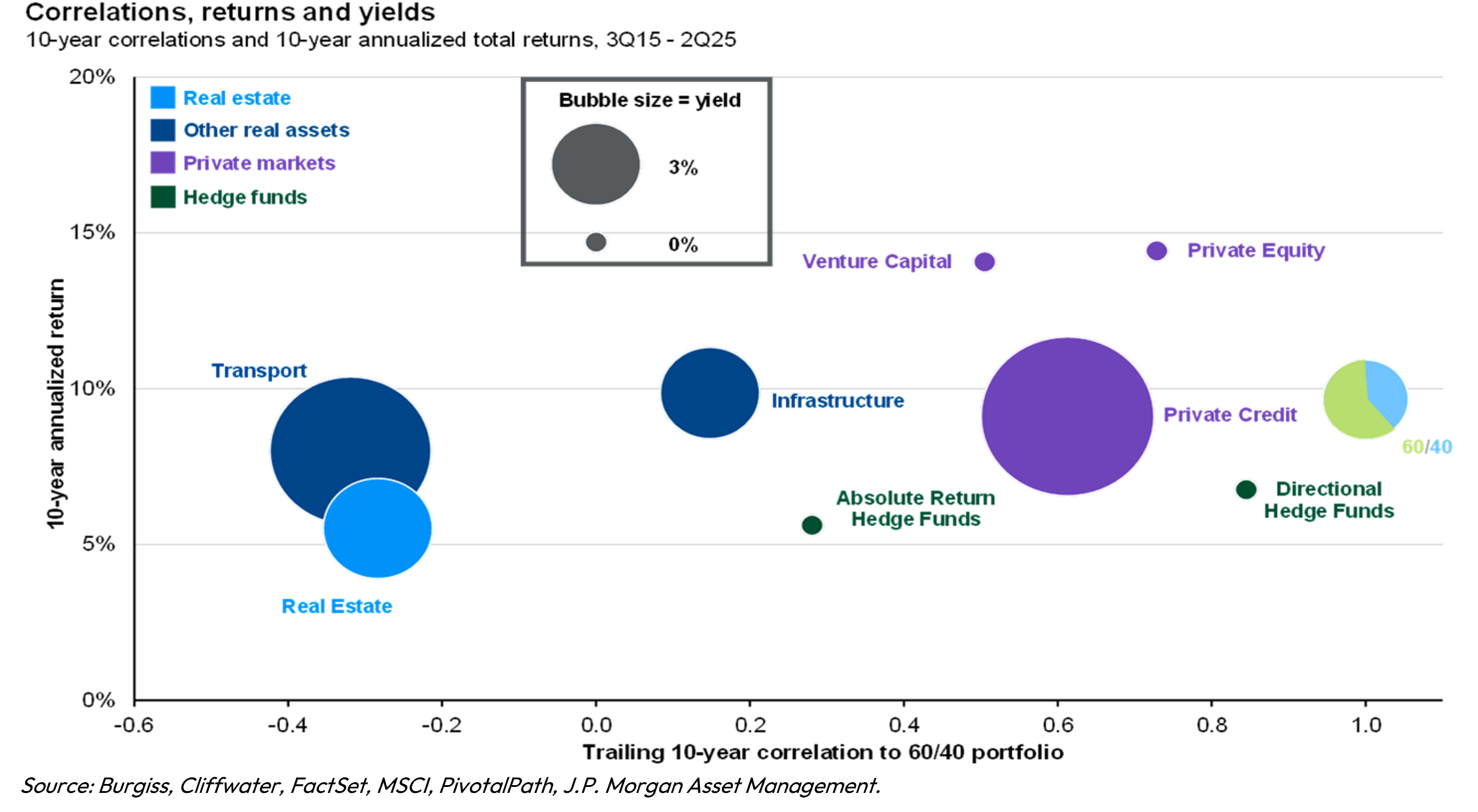

Alternative assets produced a wide dispersion of returns in 2025, highlighting the importance of diversification within the asset class. Private equity delivered strong double-digit gains, reflecting improving exit activity, resilient earnings growth, and favorable valuation dynamics relative to public markets. Private credit generated steady mid-single-digit returns, supported by attractive floating-rate income and continued demand for non-bank lending solutions. Tangible assets were a notable area of strength, with precious metals significantly outperforming amid geopolitical uncertainty, central bank easing, and sustained demand for inflation-resilient assets, while commodities posted solid positive returns overall. Hedge fund–oriented strategies delivered more modest results, reflecting a year in which trend persistence and dispersion varied across markets. Collectively, alternatives provided differentiated sources of return and diversification benefits, reinforcing their role in portfolios during a year marked by uneven market leadership. Manager selection in this asset class proved, once again, to be a main driver of returns, both absolute and relative.

2026 Investment Outlook

Looking ahead, we believe 2026 is likely to present a more complex investment environment than the past several years. We think investors’ mindset must turn to navigation. You can still do financially well, but it will take a different mentality and skillset for success than was found in 2025.

After three years of outsized equity gains, we expect returns in 2026 to be more closely aligned with long‑term historical averages, which have approximated 10% annually over the past century. In this environment, success is likely to depend less on broad market exposure and more on thoughtful positioning and risk management. We believe the following themes are likely to shape the investment landscape in 2026.

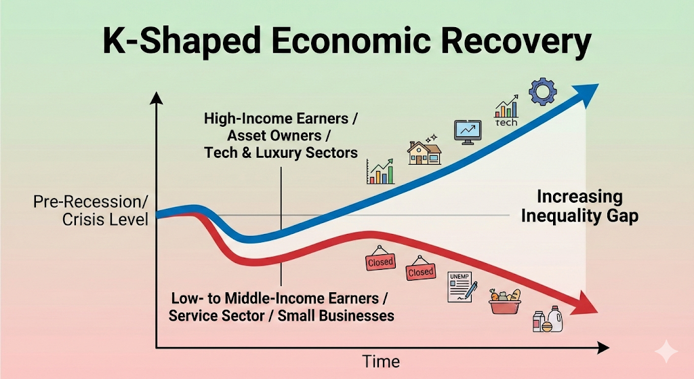

A K-Shaped Economic Environment

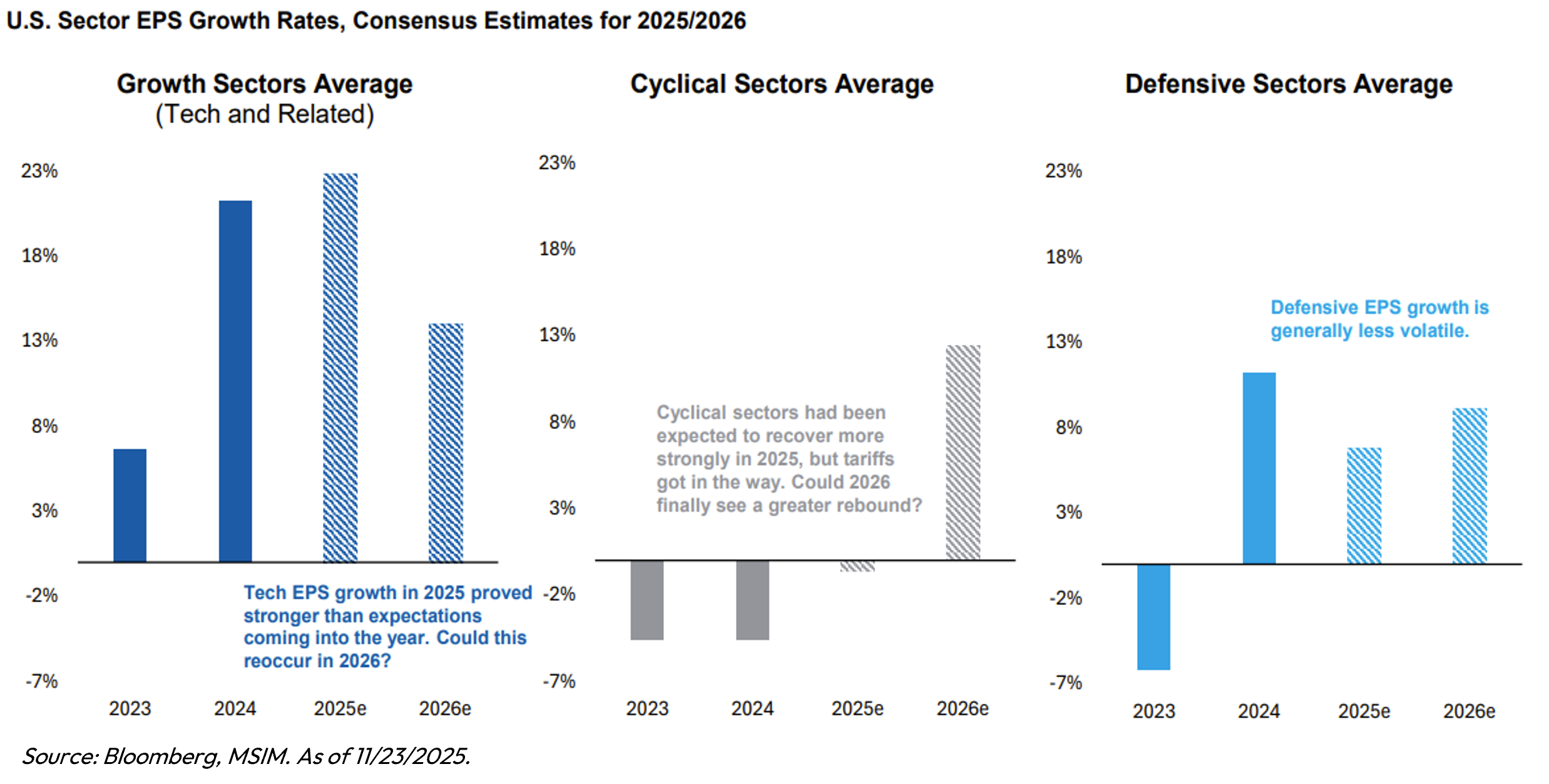

Economic conditions increasingly reflect a K‑shaped pattern, a dynamic we believe represents one of the most important considerations for investors over the next 12 to 18 months. Market performance, employment trends, inflation dynamics, GDP growth, and productivity outcomes are all likely to be influenced by this divergence.

The Upper Segment (The Winners): Certain segments of the economy continue to perform exceptionally well. These include large technology firms adopting artificial intelligence, owners of critical infrastructure assets, and households with significant assets. We believe these areas may continue to experience favorable conditions in 2026 and beyond.

The Lower Segment (The Laggards): Other areas of the economy face ongoing pressure. These include more traditional businesses, many small enterprises affected by tariff policy, companies dependent on low‑cost labor, and consumers contending with persistently elevated prices. The increasing adoption of artificial intelligence has also placed pressure on companies to improve efficiency, often forcing difficult decisions between labor and automation. These dynamics further reinforce the divergence inherent in a K‑shaped economic structure.

Source: Elyxium Wealth

Artificial Intelligence: An Ongoing Infrastructure Investment Cycle

While market attention has focused heavily on the Magnificent 7 (Nvidia, Microsoft, Google, etc.), we believe 2026 may also highlight the substantial infrastructure required to support continued AI adoption.

The investment focus is increasingly shifting from application‑level innovation toward the physical requirements of AI deployment, including computing capacity, data storage, and energy supply.

The Picks and Shovels: The winners won’t just be the software companies, but the manufacturers of the high-powered chips (the "brains"), the companies building the massive data centers ("the warehouses"), and, crucially, the energy providers.

Power Grid is the New Pipeline: AI needs electricity. This means massive investment is required to upgrade aging power grids, build more renewable energy plants, and generally get more power to these data centers. Look for companies involved in electrification and utility upgrades. Thinking outside the box is going to be necessary to supply all the energy that is needed for AI to function.

Global Fragmentation and the Retreat from Full Globalization

The global economic environment continues to evolve as efficiency‑driven globalization gives way to greater emphasis on resilience and security. In prior decades, extended global supply chains helped minimize costs; however, current conditions suggest a shift toward more localized or allied production networks.

Economic security has emerged as a central priority for both governments and corporations, leading to increased reshoring and supply‑chain diversification. While these efforts may enhance resilience, they also tend to increase production costs, contributing to higher price levels.

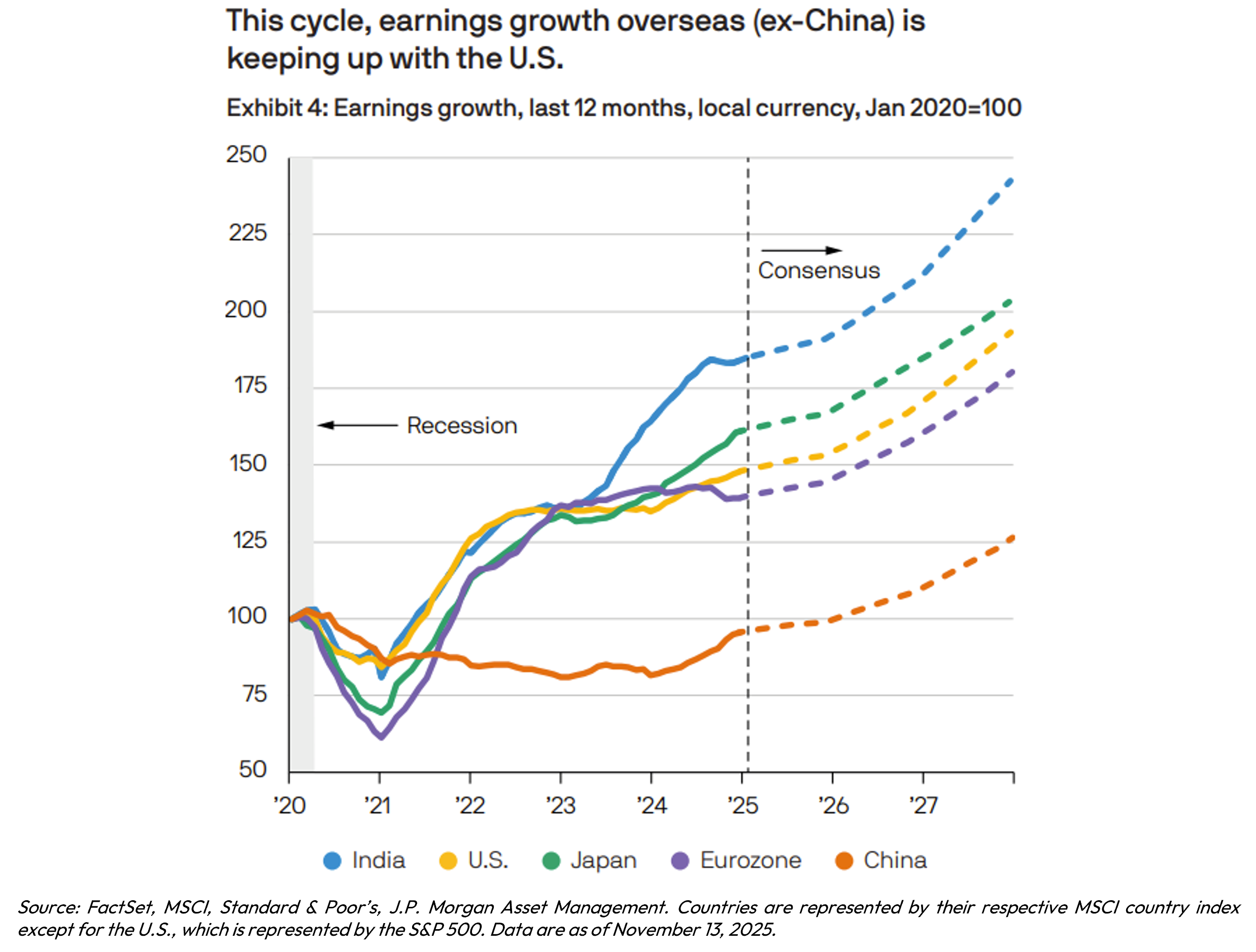

This reconfiguration of global supply chains may create opportunities outside the United States. Certain emerging markets and select European countries may benefit as manufacturing capacity relocates to regions such as Mexico, Southeast Asia, and India. We believe this environment supports continued consideration of non‑U.S. investments, consistent with our recommendations in recent quarters to increase international exposure. We believe this international allocation should continue to reward investors in 2026, as even earnings growth expectations over the next couple of years is close to that of the US.

Infrastructure and Climate‑Related Investment Themes

A broad need for infrastructure renewal remains evident across transportation networks, water systems, and electrical grids. These investments are increasingly intertwined with both climate considerations and the expanding energy requirements of artificial intelligence. We view this as a long‑duration investment theme that is not dependent on short‑term market trends.

In addition, structural shortages of critical minerals, including copper and lithium, continue to influence resource markets. As demand from electric vehicles, energy storage, and data‑center development grows, companies involved in the extraction, processing, and recycling of these materials may retain strategic importance. While pricing in these markets can be volatile, we believe select exposures may offer long‑term opportunity.

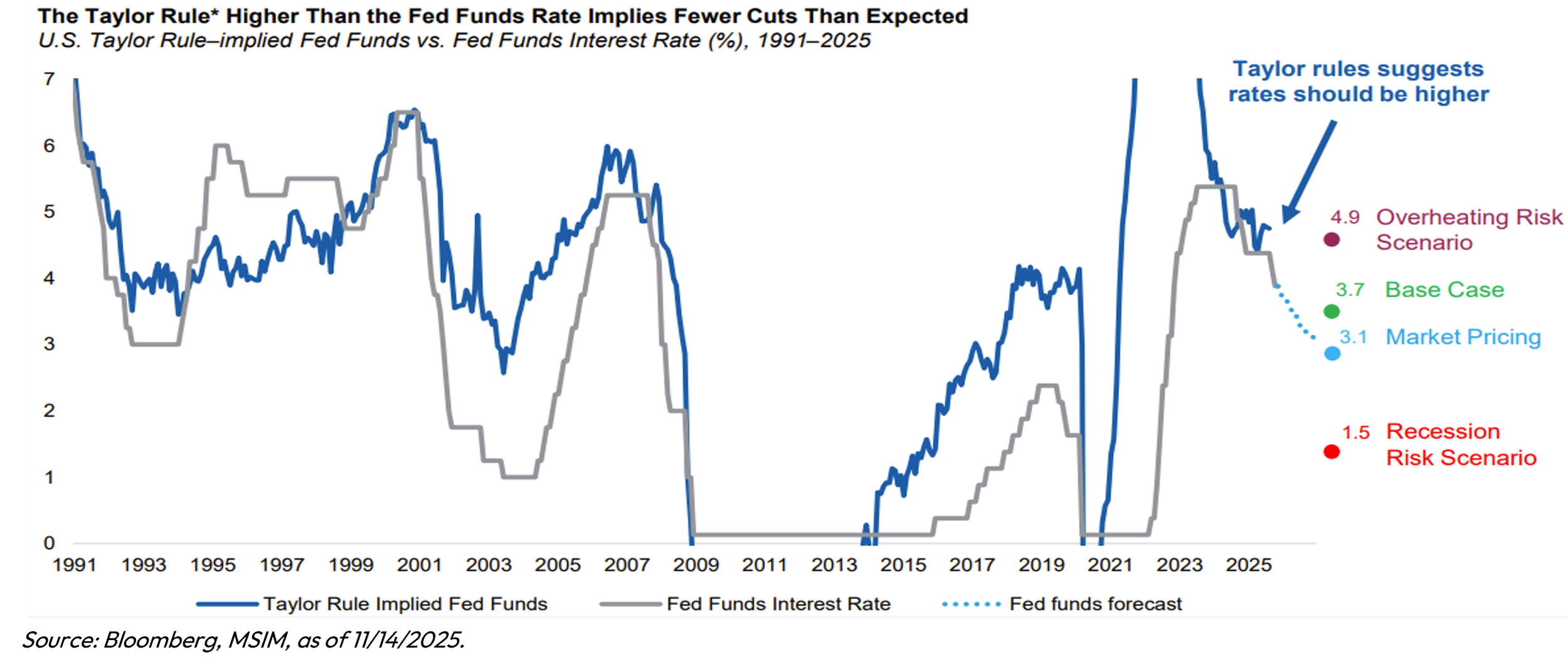

Federal Reserve Policy and Interest‑Rate Dynamics

We expect the Federal Reserve to maintain an accommodative stance in 2026, potentially reflecting a softening labor market and contained inflation pressures. Our base case anticipates two interest‑rate cuts during the year.

At the same time, we believe longer‑term interest rates may remain relatively range‑bound. With short‑term rates declining and longer‑dated yields remaining elevated, the yield curve may experience modest steepening. This environment could benefit financial institutions and provide bond investors with attractive current income, along with selective opportunities for capital appreciation in shorter‑duration segments.

The Role of Diversification and Alternative Investments

In a market environment characterized by more moderate returns, diversification remains an important tool for managing volatility and enhancing risk‑adjusted outcomes. Historically, mid‑term election years have been associated with elevated volatility, and value‑oriented sectors such as healthcare, consumer staples, and financials have tended to perform relatively well. We believe 2026 may be a year in which market leadership broadens beyond a narrow group of large technology companies.

Alternative investments may play an increasingly important role in this setting. Strategies such as long/short equity and absolute‑return approaches may be positioned to generate differentiated returns, particularly if equity markets experience greater dispersion.

Commodities and other real assets may also benefit if liquidity conditions ease and demand for critical resources remains elevated. In addition, international investments may continue to offer diversification benefits, particularly in an environment of potential U.S. dollar softness and value‑oriented market composition abroad.

Portfolio Implications

Equity Positioning

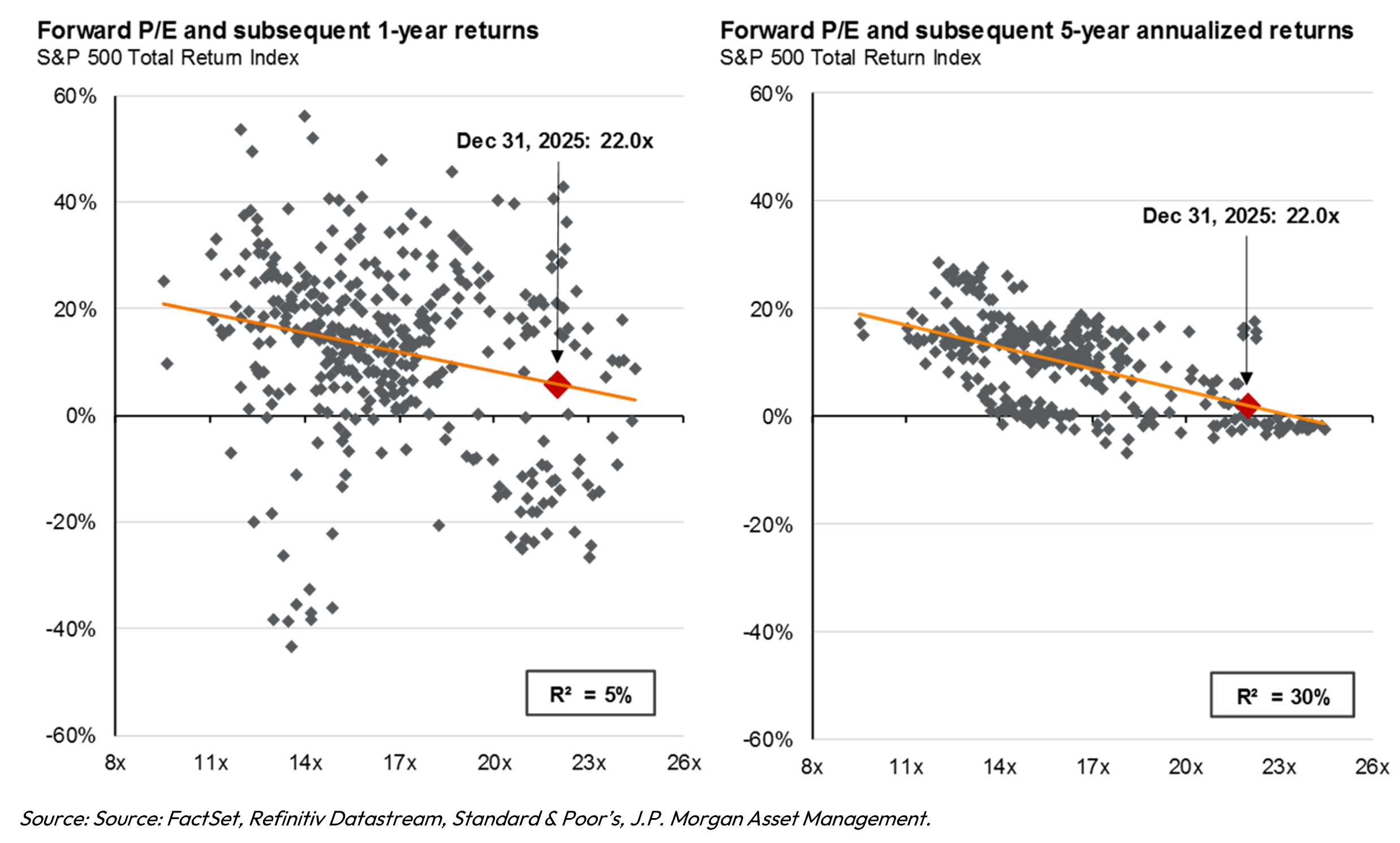

Our primary objective remains the optimization of risk‑adjusted returns. Following an extended period of equity market appreciation, valuations remain elevated by historical standards. While market dynamics, particularly the transformative potential of Artificial Intelligence (AI), might partially justify these higher multiples in specific growth sectors, historical analysis strongly suggests that high starting valuations correlate inversely with low forward returns over the next decade. While we believe valuation should never be used as a timing tool, this lesson does give us pause as we approach 2026. Because we think equity returns will be more muted in 2026, a neutral overall equity exposure to begin the year is warranted.

We also expect volatility to remain elevated, particularly given the historical tendency for mid‑term election years to experience meaningful drawdowns. We intend to use such periods opportunistically to adjust equity exposure where valuations become more attractive. We still believe the long-term bull market which started in October 2022 remains intact, as economic forecasts generally anticipate moderate-to-strong real GDP growth in 2026, driven by fiscal stimulus, monetary easing, and AI-led capital expenditure.

Earnings as the Primary Driver of Returns

Earnings expectations are high as we head into 2026, as S&P500 earnings growth is expected to be double digits in 2026. While we anticipate earnings growth will be strong in 2026, we question how much is already priced into markets. Earnings expectations typically decline throughout the year. As such, we will monitor each earning season closely looking to see the quality of numbers released by companies in the index. We also believe that earnings will be the main driver of returns, not P/E expansion, as we already trade at healthy multiples today. If earnings continue to deliver as expected, we think markets can return modest gains for investors.

Fixed Income Strategy

Despite anticipated monetary easing, yields across intermediate and longer maturities remain competitive relative to equities, particularly if inflation proves persistent. A modest steepening of the yield curve may benefit investors positioned in intermediate‑duration assets. Our clients already have exposure to the intermediate portion of the yield curve and have been enjoying the slightly higher yields that come with that positioning. We expect that to continue in 2026.

We see no recession in 2026. As such, we will look to take advantage of opportunities that exist for higher yields. Examples might include high yield debt, adding to emerging market debt, bank loans, collateralized debt obligations and other sectors of the fixed income market which compensate investors with higher interest payments.

International Exposure

We look for 2026 to be another year of strength for international markets. Global economic fragmentation—driven by geopolitical tensions, rising protectionism, and even the potential for new tariffs—introduces uncertainty that can disrupt global supply chains. This rearranging of the deck chairs provides opportunity to firms all over the world as supply chains shrink to meet new demand. Global managers are well-positioned to take advantage of this new world order.

Although we do not expect the dollar to lose another nearly 10% against major currencies in 2026 as it did in 2025, it may struggle to regain dominance. The same factors that lead to its weakness, Federal Reserve interest rate cuts, US fiscal concerns and changing investor sentiment, sure don’t look to be changing dramatically in 2026. Dollar weakness is beneficial to international investors as they are paid in currencies that are now more “valuable”.

Alternative Investments

With muted returns expected in 2026, we think alternative investments will prove to be an excellent investment choice. Owning assets whose returns are uncorrelated to overall market direction should prove beneficial not only in increasing returns in overall investor portfolios, but also in reducing the risk associated with those returns.

As we enter 2026, not only do we wish our clients to maintain exposure to this broad asset class, but we are also taking steps within the asset class to reduce market (beta) exposure within our manager selection and weights. These changes that we will be making in early 2026 will position clients for the potential for high absolute returns within the asset class regardless of overall market direction. Many of our alternative managers delivered strong alpha (manager skill) in 2025. If they are able to replicate this feat in 2026, they should be able to reward clients once again.

Conclusion

We are forecasting modest returns in 2026, after three years of strong gains. We emphasize a “smarter” approach to investing, shaped by six major themes: a K-shaped economy with tech and AI leaders thriving while traditional businesses may lag; an ongoing AI infrastructure arms race, driving demand for chips, data centers, and energy upgrades; global fragmentation as countries prioritize economic security and reshoring, potentially benefiting international markets; continued focus on infrastructure and climate, including resource scarcity for minerals like copper and lithium; a dovish Federal Reserve, likely cutting rates twice and potentially leading to a steepening of the yield curve; and the importance of diversification, with alternative investments, commodities, and international markets playing an important role in client portfolios.

We advise a neutral equity exposure initially, but we are prepared to do some opportunistic buying during expected volatility. We look forward to an interesting 2026 and will be here to assist you in what may prove to be a more complex market environment.

Elyxium Wealth LLC (“the FIRM ”) is a registered investment adviser located in Beverly Hills, California. The FIRM may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This presentation is limited to the dissemination of general information regarding the FIRM’s investment advisory services. Accordingly, the information in this presentation should not be construed, in any manner whatsoever, as a substitute for personalized individual advice from the FIRM. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Any client examples were hypothetical and used to demonstrate a concept.

Past performance is not indicative of future performance. Therefore, no current or prospective client should assume that future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the FIRM), or product referenced directly or indirectly in this presentation, will be profitable. Different types of investments involve varying degrees of risk, & there can be no assurance that any specific investment or investment strategy will suitable for a client’s or prospective client’s investment portfolio.