2026 Alternative Investment Outlook: The Great Re-Physicalization- Allocating Capital in the Era of Scarcity

“I have decided not to participate in any recession.” — Sam Walton

Executive Summary: The Structural Break and the End of the Paper Era

The investment landscape of 2026 represents a decisive and irrevocable structural break from the post-2008 financial paradigm. For nearly two decades, global capital markets were defined by "financialization"…a regime characterized by the dominance of software margins, Zero Interest Rate Policy (ZIRP), low inflation, and the frictionless, localized movement of capital across global borders. That era has definitively concluded. We are witnessing a collision between the digital ambitions of Artificial Intelligence and the physical limitations of our energy grid, our supply chains, and our demographics.

The consensus view which largely anticipates a return to the low volatility "Great Moderation" we believe fundamentally underestimates the structural inflationary pressures inherent in this new regime. We are witnessing what can be described as a "Regime Change," where the "resting heart rate" of inflation and interest rates will likely remain structurally higher than the 2010-2020 average.

The fundamental premise of our 2026 Alternative Investment Outlook is predicated on the notion of focusing on segments of markets that have bottlenecks, unique supply/demand dynamics, and have secular forces behind them. This emphasis, we believe, is not merely cyclical but secular, being driven by a convergence of five Mega Forces. The connecting thread weaving these disparate themes together is scarcity.

The research synthesized for this report points to a clear conclusion: we believe the winners of the 2026 cycle will be those who own the "choke points" of the physical economy. The following provides a data-driven analysis of these themes and delineates five high-conviction investment opportunities for the foreseeable future that we believe will be constructive for portfolio design and construction: The Energy Logistics Supercycle, Strategic Sovereignty, The "Unloved" Real Estate Pivot, The Liquidity Barbell, and the Return of Alpha.

Our Top 5 High-Conviction Themes for 2026:

The Industrial AI Complex and the Energy Logistics Supercycle: Moving beyond the "chip" to the "grid." The buildout of AI infrastructure is a $1 trillion industrial revolution stressing the U.S. power grid. We target the supply chain bottlenecks specifically electrical equipment manufacturers and grid hardening plays that possess multi-year backlogs and pricing power. Capitalizing on the "Firming Gap." Renewables cannot power data centers 24/7. Natural gas pipelines and nuclear energy are the only viable baseload solutions.

Strategic Sovereignty: Geopolitics is becoming a primary driver of capital allocation. As globalization fractures, capital is flowing to "Dual-Use" purposes, Defense Tech and domestic manufacturing. We focus on opportunities bridging the gap between Silicon Valley innovation and National Security requirements and interests.

"Unloved" Real Estate Pivot: A rotation from "Generic Industrial" to "Scarcity Assets." We are targeting Grocery-Anchored Retail (zero new supply) and focusing on Housing (demographic inevitability), capitalizing on the divergence between commodity real estate and needs-based real estate.

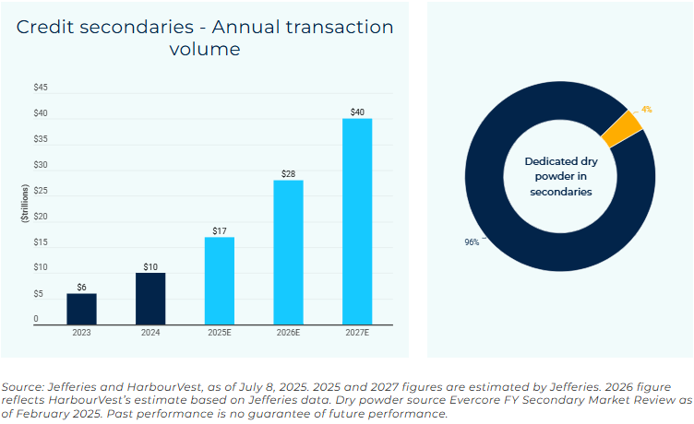

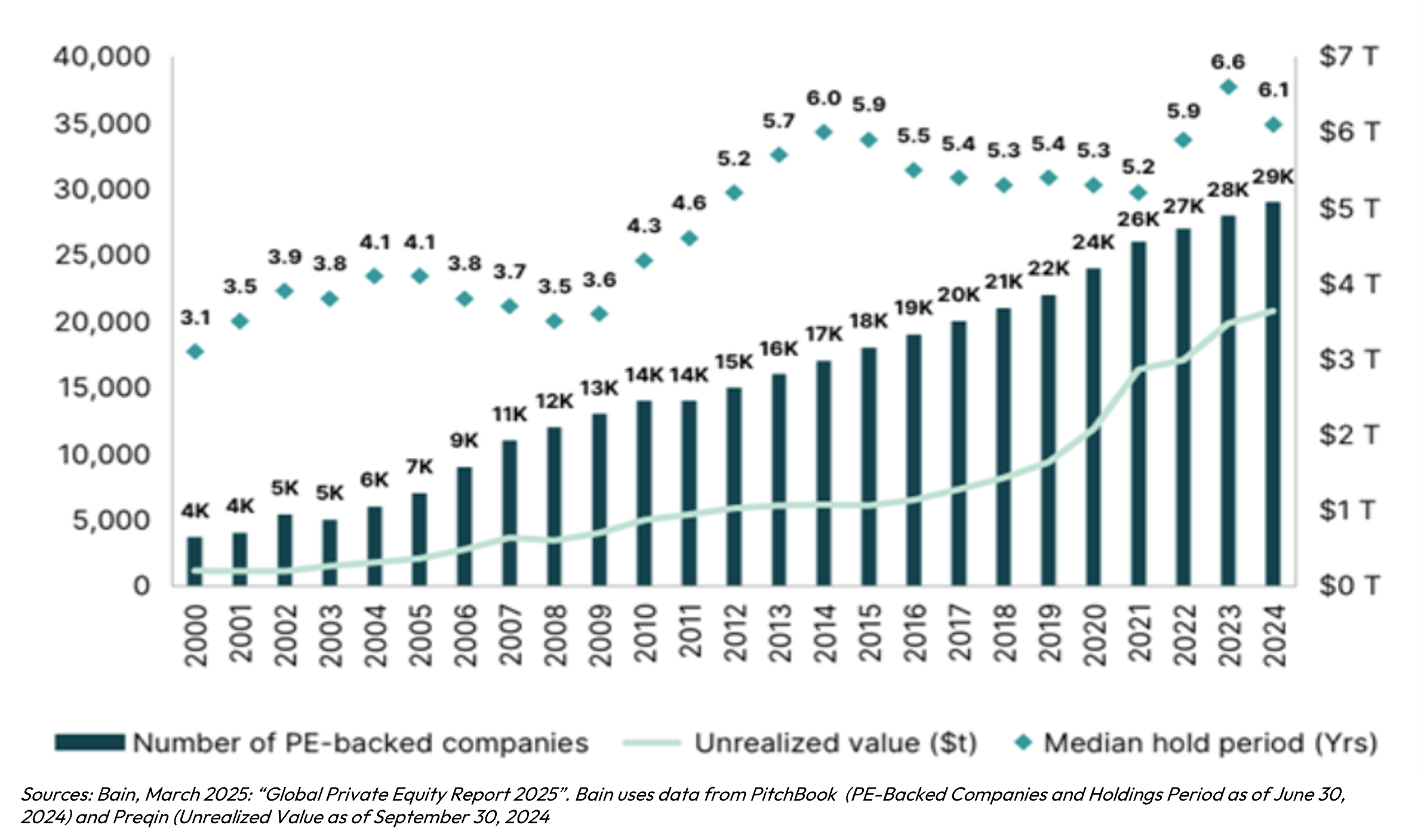

The Liquidity Barbell: Addressing the $1 trillion debt Maturity Wall. We advocate for a paired strategy of Private Equity Secondaries (buying growth at a discount) and Opportunistic Rescue Capital (providing opportunistic debt to good owners with bad balance sheets).

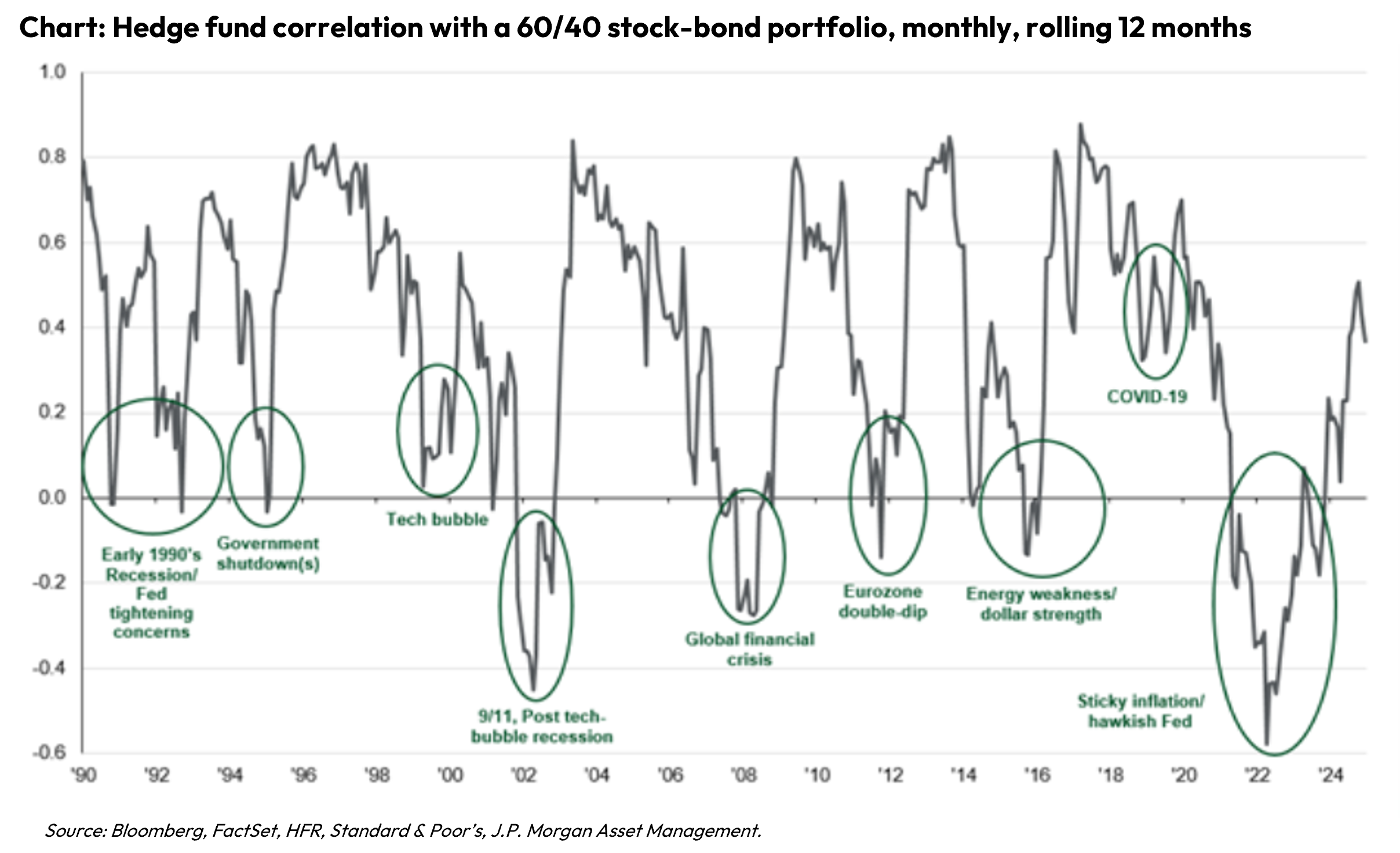

The Return of Alpha: The AI effect across companies may exacerbate the segmentation of winners and losers. With elevated rates of equity dispersion and correlations between bonds and stocks continuing positively with a higher base fed funds rate, we focus on equity market neutral strategies and global macro. Increasing active risk while minimizing market beta we believe may continue to be alpha generative. The dynamic and quick-to-changing nature of these managers should prove useful in offering adaptable risk-adjusted returns if markets experience episodic volatility.

Macro Context: The Regime Change and the Return of Scarcity

To understand the specific investment opportunities of 2026, one must first accept the premise that the macroeconomic machinery has changed. The "Regime Change" thesis posits that the deflationary tailwinds of the past which included cheap energy, cheap labor, and cheap American capital which have all reversed simultaneously to a measurable degree.

The re-industrialization of Western economies is an inherently inflationary process. The United States is currently engaging in three simultaneous capital-intensive buildouts: the re-shoring of the industrial base (driven by the CHIPS Act and IRA), the hardening of the electrical grid, and the construction of the AI physical layer. This creates immense competition for skilled labor, raw materials, and specialized equipment.

As central banks maintain restrictive policies to combat this structural inflation, the availability of public capital has been constrained. Government debts and deficits have risen to levels that crowd out private borrowing, creating a "capital constraint" in public markets. This elevates the role of private capital. We are entering a "golden age" for private infrastructure and credit, as banks have retreated from lending due to regulatory pressures (Basel III Endgame) and balance sheet preservation. BlackRock notes that the AI buildout requires such massive, front-loaded investment that the "micro is macro”. The specific capital needs of a single sector may be large enough to distort broad credit markets.

In this environment, "diversification" using broad indexes could be argued as a mirage. When markets are driven by a few mega-forces (like AI and Energy), traditional diversifiers like long-dated bonds may offer less cushion against risk asset selloffs. True diversification in 2026 requires exposure to idiosyncratic return sources…assets that move based on their own supply/demand dynamics rather than the Federal Reserve's dot plot. This leads us directly to our first and most dominant theme: The Industrial AI Complex and the Energy Logistics Supercycle:

Theme 1. The Industrial AI Complex and the Energy Logistics Supercycle:

From Software to Hardware: The "Micro is Macro" Shift

The narrative surrounding Artificial Intelligence has historically focused on Large Language Models (LLMs), chatbots, and software applications. As I look toward 2026, the investment thesis is shifting violently from the "brain" (software) to the "body" (infrastructure). The "Micro is Macro" concept suggests that the capital spending ambitions of hyperscalers (Amazon, Google, Microsoft, Meta) are so massive that they may be altering macroeconomic conditions.

The sheer scale of this buildout is colliding with physical reality. The AI data center boom is not merely a digital phenomenon; it is a heavy industrial expansion that is stressing the U.S. power grid to a bottleneck of supply and demand.

The AI Power Demand Shock

By 2026, the impact of AI on energy consumption has moved from theoretical forecast to physical reality. Data center power demand is projected to grow 160% by 2030, a trajectory that became undeniably visible in 2025 utility filings. The computational intensity of Generative AI requires rack densities that traditional grids cannot support without massive reinforcement.

This demand shock has exposed the fragility of the "electrify everything" thesis when relying solely on intermittent renewables. While solar and wind capacity continues to expand, the firming capacity, power available 24/7 regardless of weather has lagged. This gap has catalyzed a "nuclear renaissance" and, more immediately, a pragmatic re-embrace of natural gas as a transition fuel.

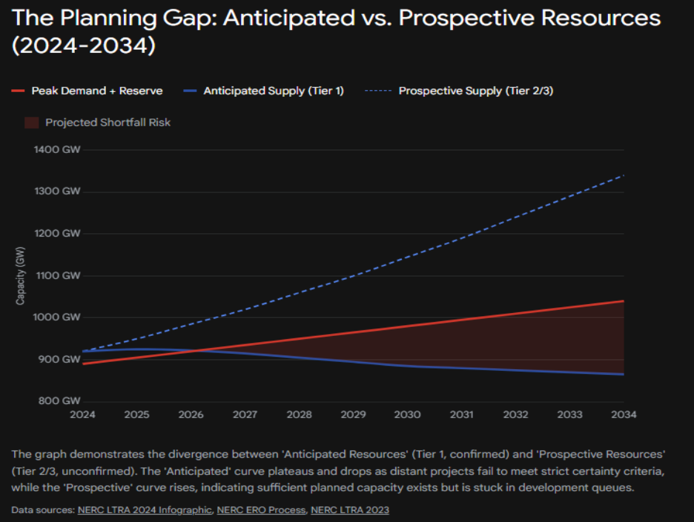

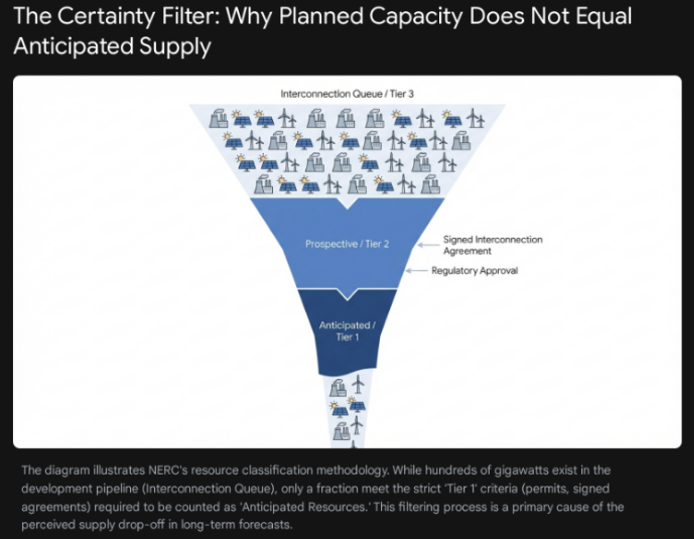

The Widening Supply-Demand Gap

Data center capacity in the United States is facing a massive shortfall. Demand from hyperscalers is compounding at a rate that the physical construction industry cannot match. Projections indicate a 10-gigawatt (GW) capacity deficit by 2028, a gap roughly equivalent to the power consumption of 7.5 million homes.

This gap is not due to a lack of financial capital; hyperscalers have hundreds of billions in cash. It is due to a lack of physical infrastructure…specifically, the backlog in the electrical supply chain and the slow pace of utility interconnections.

The Supply Chain Choke Point: Transformers and Switchgear

The most acute bottleneck in this ecosystem is the electrical supply chain. High-voltage transformers, the critical nodes that step down power from the transmission grid to the data center, are seeing lead times extend to historic lengths.

Lead Times: It now takes an average of three years to acquire high-voltage transformers and one year for distribution transformers.

Price Inflation: Prices for transformers have surged, with estimated average price growth of 15% in 2024 and projected growth of 8-10% in 2025. Even as supply chain tightness moderates slightly in 2026, prices are expected to remain elevated with 3-5% growth on top of the new, higher baseline.

Supply Deficit: The "supply deficit" for power transformers is expected to hit 30% in 2025, with distribution transformers facing a 10% deficit.

This backlog creates a bifurcated market. Utilities and developers with secured supply chains and pre-ordered equipment are proceeding, while those without are stalled or forced to pay exorbitant premiums. This creates a powerful moat for incumbent industrial manufacturers like who are seeing their backlogs swell with long-dated orders. Eaton Corp, for instance, explicitly notes that the shift to AI data centers is driving a transition to High-Voltage Direct Current (HVDC) power infrastructure, a trend they are partnering with NVIDIA to accelerate. Eaton expects data center electricity demand to double by 2026, driving a massive upgrade cycle that extends well beyond just the transformers to the entire power management stack.

Grid Hardening as a National Imperative

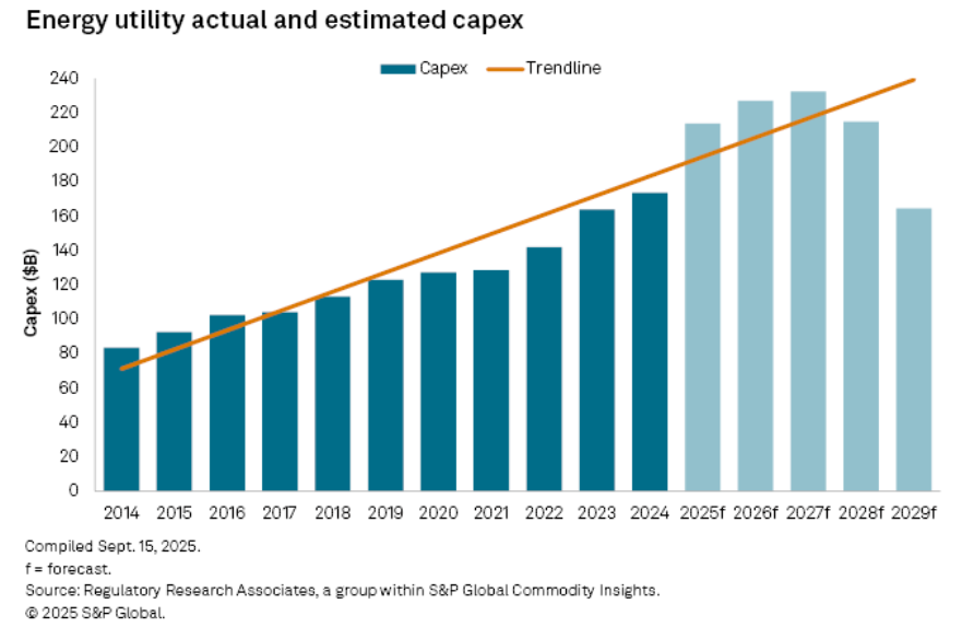

The U.S. electrical grid is aged, fragile, and ill-equipped for this surge. The surge in demand from AI, coupled with the "electrification of everything" (EVs, heat pumps), is pushing the grid to its breaking point. The Department of Energy has warned that blackouts could increase significantly by 2030 without radical capacity additions. This has triggered a massive capex cycle for regulated utilities, known as "Grid Hardening."

Capital expenditures for U.S. energy utilities are forecast to top $212 billion in 2025 (a 22% increase year-over-year) and reach $222 billion in 2026. This spending is largely protected by regulatory frameworks that allow utilities to pass costs to consumers, providing a rare degree of earnings visibility in a volatile macro environment. The "Gold Rush" for power is leading to unprecedented partnerships, such as hyperscalers funding utility upgrades directly to jump the interconnection queue.

The Limitations of the "Renewables Only" Strategy

For the past decade, the dominant energy narrative was a linear transition to wind and solar, often at the expense of dispatchable thermal generation. By 2025, that narrative has fractured. The intermittency of renewable energy is fundamentally incompatible with the 24/7, 99.999% uptime requirements of AI data centers. A data center cannot wait for the wind to blow or the sun to shine. This physical reality has catalyzed an "Energy Renaissance" focused on firm, baseload power: Natural Gas and Nuclear.

Natural Gas: The Indispensable Bridge

Despite long-term decarbonization goals, natural gas has emerged as the only fuel source capable of bridging the immediate gap between current power demand and future nuclear capacity.

Data Center Demand: Natural gas demand from U.S. data centers is forecast to rise by 3 to 6 billion cubic feet per day (Bcf/d) by 2030. This new demand vector is structural and largely insensitive to price, as energy costs are a fraction of the value of the compute being generated.

Infrastructure Constraints: Pipeline capacity has lagged behind demand for a decade due to permitting challenges. Midstream operators like Williams Companies (WMB) are now critical bottlenecks. Williams is aggressively investing over $5 billion in "behind-the-meter" gas solutions to power data centers directly, effectively bypassing the congested electrical grid. These projects, such as the ones supporting data centers in Ohio and Texas, utilize gas turbines co-located with the data facilities, ensuring power reliability that the grid cannot match.

Price Outlook: The Energy Information Administration (EIA) forecasts Henry Hub natural gas prices to average $4.00/MMBtu in 2026, a 16% increase from 2025 levels. This bullish pricing environment supports margins for producers and midstream operators alike, signaling an end to the "gas glut" of 2023-2024.

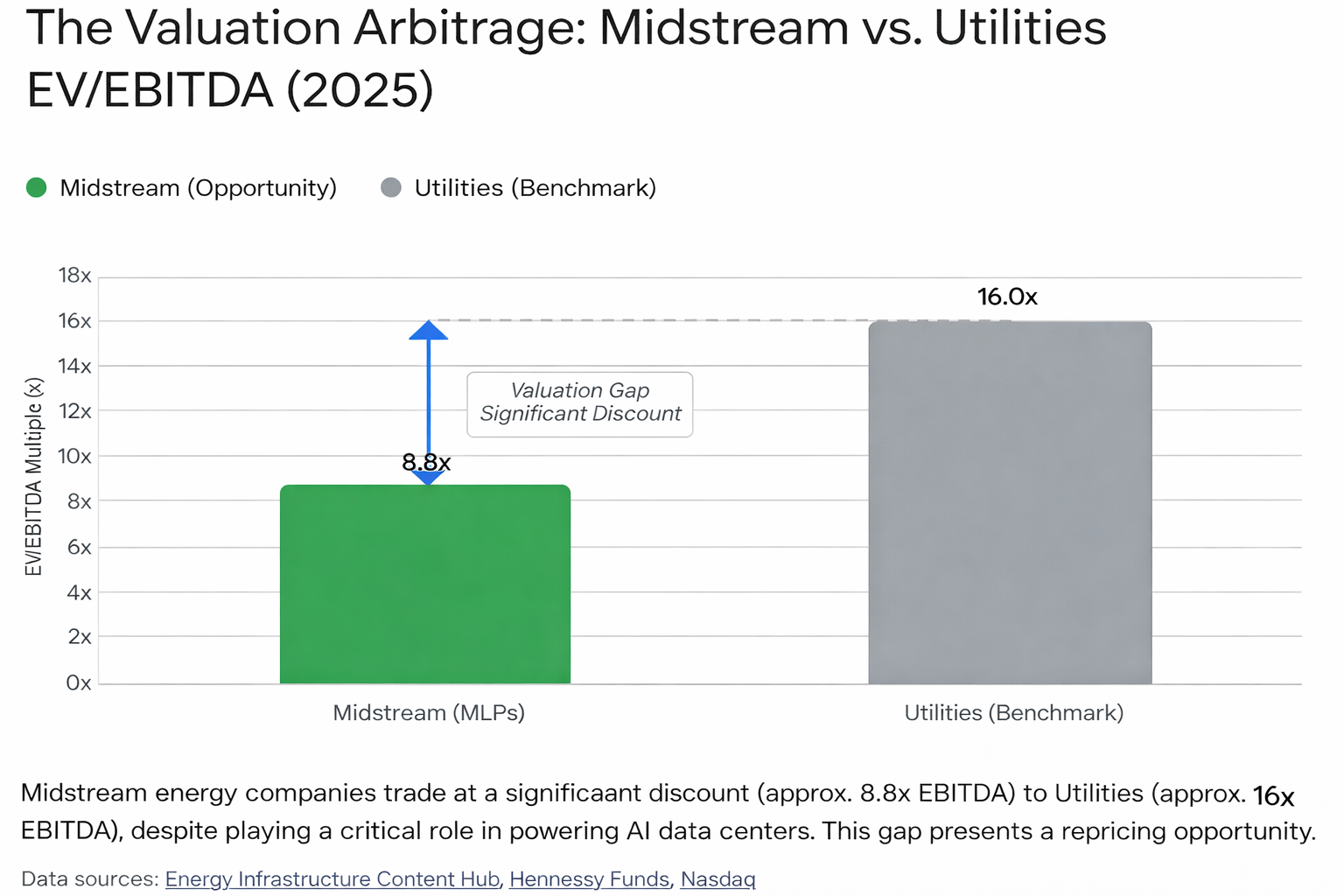

One Example of The Opportunity: Energy Infrastructure

The Thesis: Pipelines are the new "AI Railroads." Natural gas demand from data centers requires expanded pipe capacity, but building new interstate pipelines is nearly impossible due to permitting gridlock. This makes existing pipeline networks immensely valuable as irreplaceable infrastructure.

Valuation Arbitrage: Despite playing a critical role in the "AI Power" theme, Midstream companies trade at a significant discount to Utilities. Midstream companies trade at 8.8x EV/EBITDA, compared to Utilities at 16x. Whilst Utilities earnings growth have outpaced Midstream companies, this may adjust as the market could deem/recognize midstream companies as a "pseudo-utility" for AI and this valuation gap may close which may result in the potential for significant multiple expansion potential.

Investors must look downstream from the chip designers (Nvidia, AMD) to the "picks and shovels" providers of the physical grid. The winners in 2026 may be the companies that manufacture the switchgear, lay the transmission lines, and manage the complex logistics of grid modernization.

This is "Industrial AI", not the code itself, but the massive industrial machine required to run it.

Theme 2: Strategic Sovereignty

The Return of Geopolitics

In the Natixis Institutional Outlook, "Geopolitics" replaced "Inflation" as the number one risk for investors. The era of benign globalization, characterized by optimized just-in-time supply chains and reliance on potential adversaries for critical goods is changing. It has been replaced by Great Power Competition. This shift is driving "Strategic Sovereignty"…the desire for nations to control their own supply chains, defense capabilities, and critical infrastructure.

Defense Tech vs. Legacy Prime

The conflict in Ukraine and rising tensions in the Pacific have exposed the limitations of the traditional U.S. defense industrial base. It has proven to be too slow, too expensive, and lacking in manufacturing depth ("mass"). This realization has opened the door for "Defense Tech"…agile, software-defined hardware companies that can iterate quickly and deploy autonomous systems at scale.

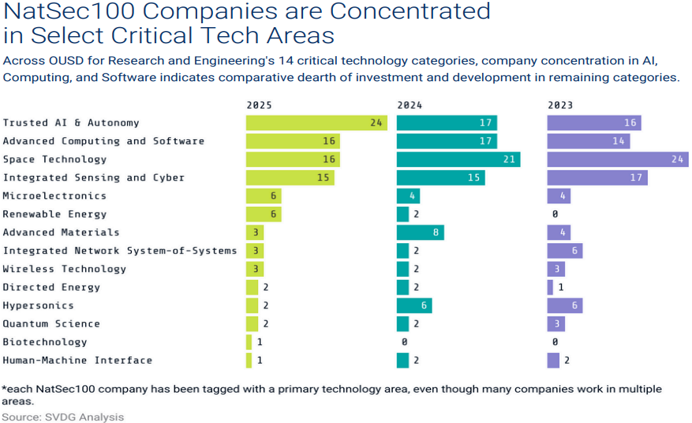

The Rise of Dual-Use: Companies like Palantir and Anduril (private) have demonstrated that Silicon Valley speed can apply to the battlefield. The NatSec 100 report for 2025 highlights a maturing market where adoption is finally following innovation, with dual-use technologies (tech that has both commercial and military applications) gaining significant traction.

Public Market Implications: Legacy primes are not obsolete; they are evolving. General Dynamics (GD) and RTX Corp (RTX) remain critical for their manufacturing scale since you cannot build a nuclear submarine in a startup garage. However, they are increasingly partnering with or acquiring smaller tech firms to modernize their platforms. The defense sector in 2026 offers a unique combination of growth (driven by rising global defense budgets) and stability (government contracts).

Reshoring as Industrial Policy

Strategic Sovereignty also necessitates "re-shoring" manufacturing. This is not just political rhetoric; it is visible in order books and construction data. Construction of manufacturing facilities in the U.S. has surged, driven by legislative catalysts like the CHIPS Act and the Inflation Reduction Act.

This industrial buildout requires massive amounts of electrical equipment, HVAC systems, and automation. A modern semiconductor fab consumes as much power as a small city and requires ultra-pure water and air handling systems. This "re-industrialization" creates a secondary demand wave for the same "Grid Hardening" plays discussed in Theme 1. The U.S. manufacturing construction boom effectively provides a "double dip" of demand for industrial infrastructure providers, once for the AI data centers, and again for the new factories.

The transition to "Re-Physicalization" does not just require energy and land; it requires the literal building blocks of the future. The AI Logistics Supercycle and Strategic Sovereignty go hand in hand. At its core, a metals consumption cycle. We are witnessing a collision between exponential demand (AI, Grid, Defense) and inelastic supply (a decade of underinvestment in mining). We emphasize four metals key to this thesis: Silver, Palladium, Copper, and Gold.

Silver is often miscast as merely "poor man’s gold." In 2026, it is properly understood as a critical industrial component. Silver is uniquely positioned to benefit from two mega-trends: Solar Photovoltaics (PV): Solar panels now consume over 25% of annual silver supply. With the "Energy Renaissance" driving record solar installations, this baseload demand is locked in. In relation to AI Hardware, Silver’s conductivity makes it essential for high-end electronics and semiconductor packaging.

Palladium and The Hydrogen Angle: Looking further out, Platinum Group Metals (PGMs) play a vital role in the Hydrogen economy (electrolyzers and fuel cells) used for backup power in green data centers. Slower-than-expected EV adoption and consumer preference for Hybrids (which still use catalytic converters) keep Palladium demand stickier than the bearish consensus expects. The transition to electric vehicles has been slower than many forecasts. Palladium offers deep value for contrarian investors forecasting a more prolonged energy transition rather than a clean overnight switch.

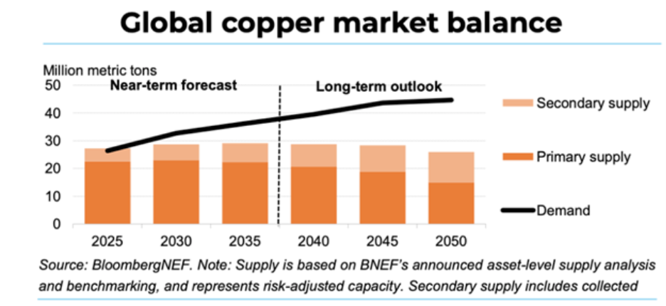

Copper is the new barrel. It is the single most critical mineral for the 2026 ecosystem. It wires the data centers, winds the transformers, and transmits the power. JPMorgan forecasts that data centers alone will add roughly 500,000 metric tons of copper demand in 2026. This is a new, structural demand wedge that did not exist five years ago. While demand accelerates, supply is stagnant. Global mine supply growth is forecast at a meager 1.4% for 2026. Major mines (such as Grasberg in Indonesia) face disruptions and grade declines.

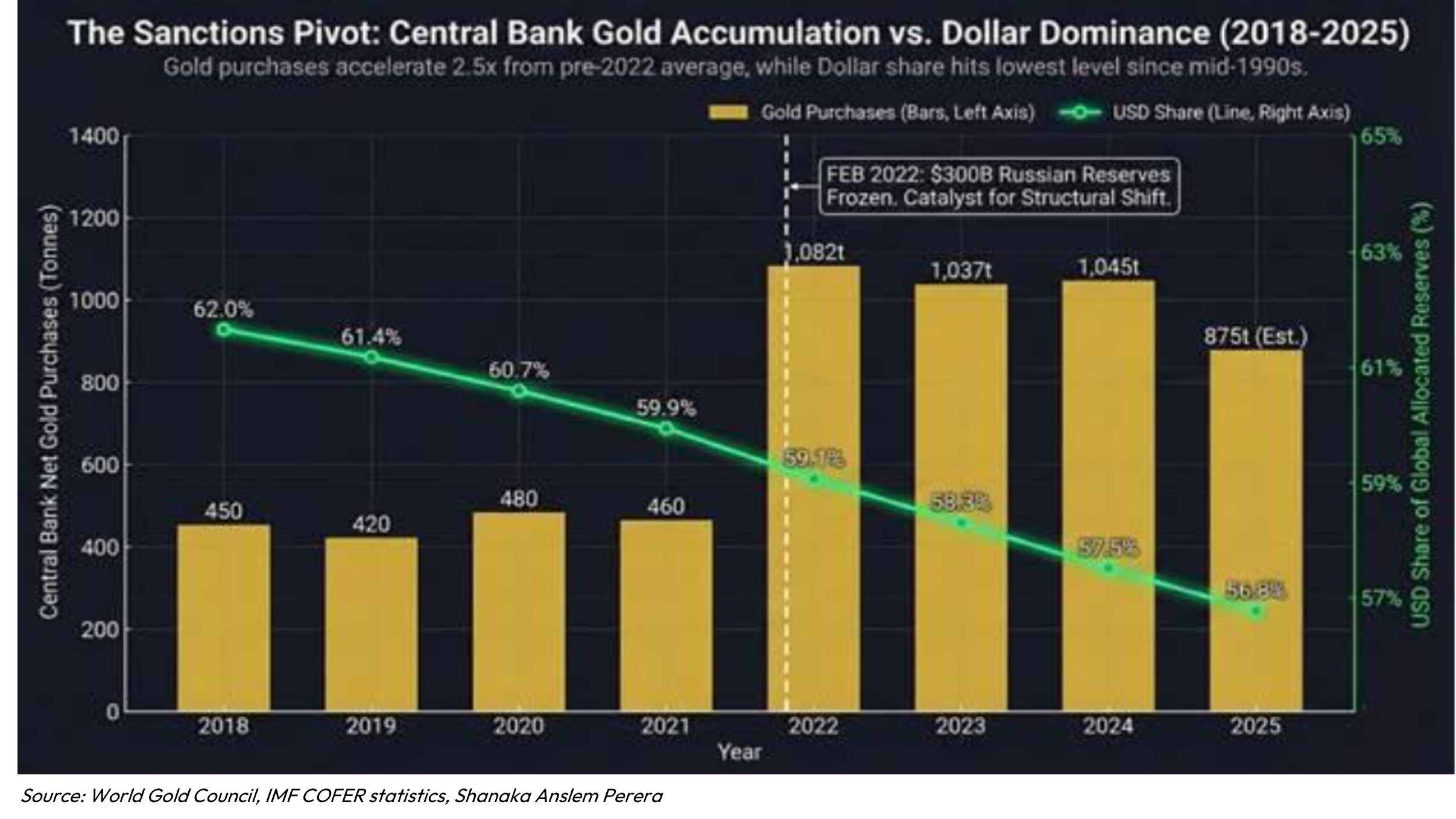

Gold is distinct from the industrial metals above. Its utility in 2026 is monetary. Gold is distinct from the industrial metals above. Its utility in 2026 is monetary and part of the multipolar geopolitical world that is developing. Gold is being touted as a "Debasement Hedge": The massive capex requirements for AI, Defense, and the Grid ($1 Trillion+) are being funded by government deficits and debt. This fiscal dominance we believe can and may induce more structural inflationary pressures longer-term. "Strategic Sovereignty" extends to central banks (China, India, Poland) diversifying reserves away from Treasuries and into gold to a minor degree.

Theme 3: "Unloved" Real Estate Pivot

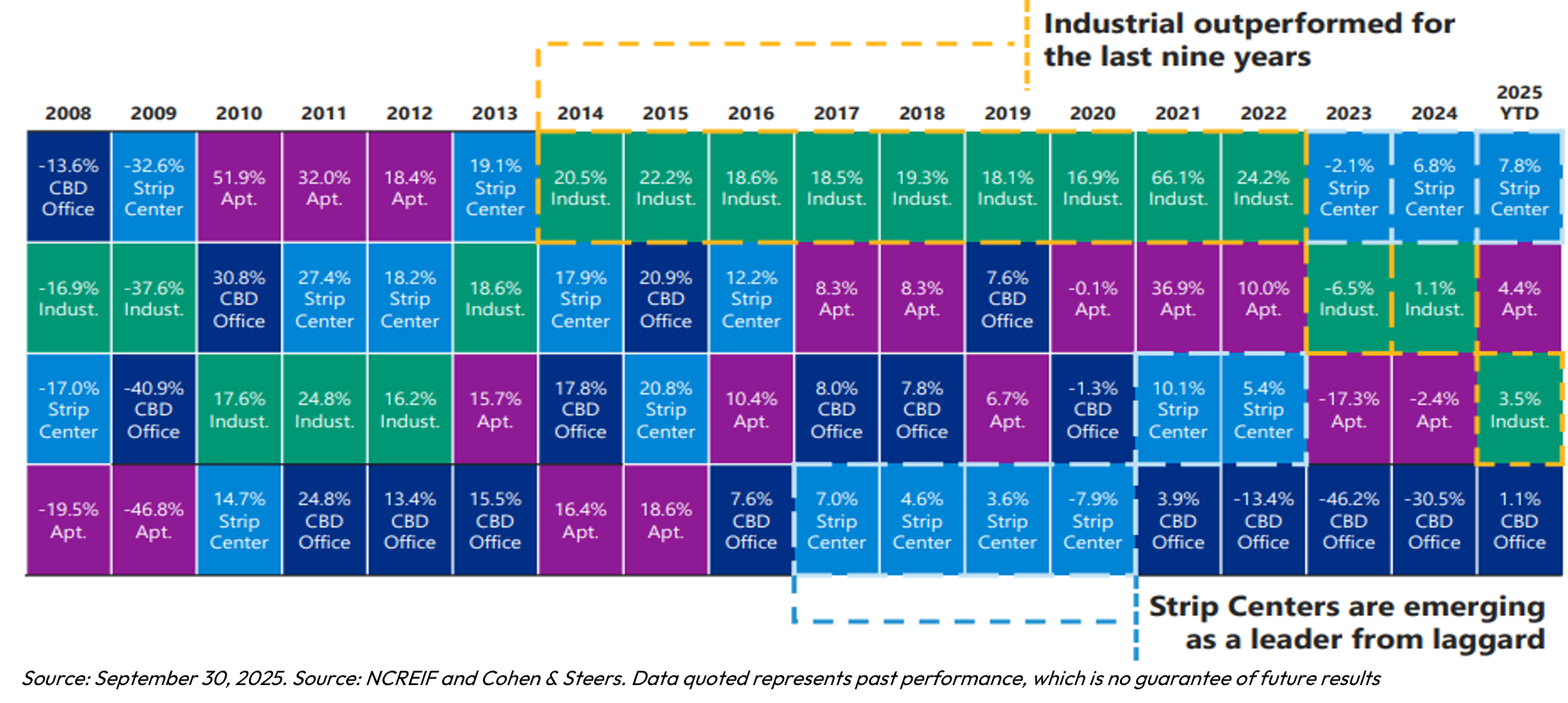

For the past decade, the institutional consensus has been governed by a monolithic "Long Industrial, Short Retail" heuristic, predicated on the belief that e-commerce would render the physical storefront obsolete. However, we are now witnessing a Structural Inversion.

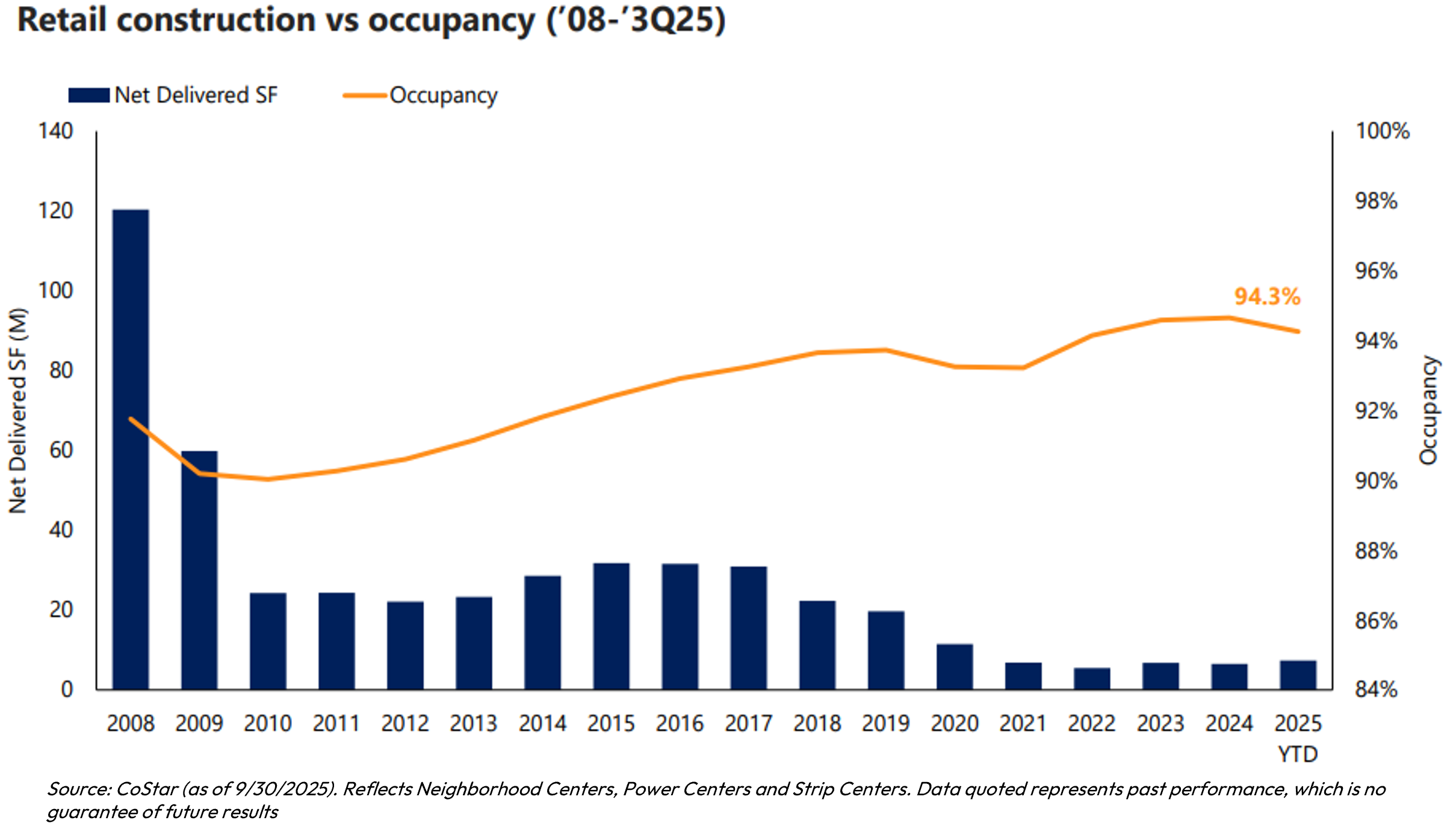

The so-called "Retail Apocalypse" was not a terminal event but a clearing cycle that purged inefficient supply. As we enter 2026, the risk lies not in the "dying" strip mall, but in the overcrowded industrial sector. While the industrial market digests a massive pandemic-era supply glut with vacancy rates in "Big Box" logistics drifting toward 8%, the retail sector is facing a historic "Supply Cliff." Net deliveries of new retail space have collapsed to just 0.2% of inventory, effectively zero. In a resource-constrained world, the assets that are hardest to build hold the most value, and today it is significantly harder to entitle a neighborhood shopping center than a warehouse.

Simultaneously, the economic function of the physical store has metamorphosed. The grocery-anchored center is no longer merely a point of sale; it has evolved into a "Last-Mile Logistics Fortress." Retailers have recognized that shipping from a remote warehouse is margin-erosive, whereas utilizing the physical store as a micro-fulfillment node (Buy Online, Pick Up In-Store) subsidizes logistics costs. Furthermore, the tenant mix has shifted toward "Med-tail"—urgent cares, dialysis centers, and service providers—creating an internet-resistant ecosystem where the physical location is essential to the tenant’s business model.

This divergence creates a compelling Valuation Arbitrage. Despite superior occupancy fundamentals and higher barriers to entry, high-quality Retail still trades at a ~150 basis point yield premium to Industrial assets (approx. 6.75% vs. 5.25% cap rates as of late 2025). We view this spread as structurally unjustified given the credit quality of essential anchors like Kroger or Publix compared to speculative logistics tenants. We anticipate a compression in 2026, where institutional capital rotates back into the sector to capture this yield, driving significant asset appreciation for early allocators.

The "Rescue Capital" Opportunity: Multifamily Preferred Equity

Arbitraging the Dislocation Between Operational Vitality and Structural Insolvency

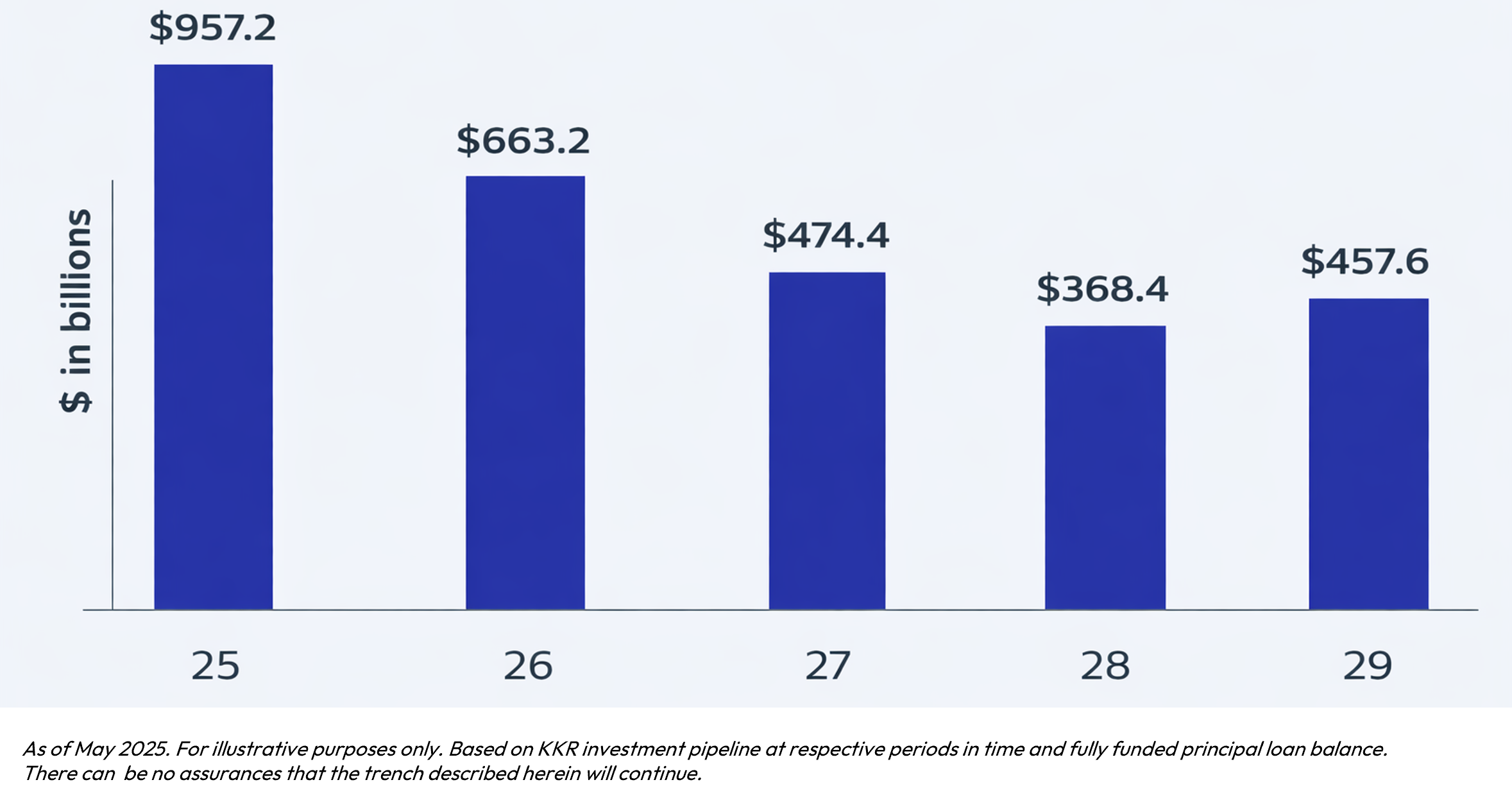

The precipitous rise in the cost of capital has engendered a profound dislocation within the commercial real estate market, creating a distinct bifurcation between asset-level fundamentals and capital structure viability. We are currently observing a widespread phenomenon where high-quality multifamily assets, characterized by stabilized occupancy, robust rent growth, and competent sponsorship are facing "Technical Insolvency" upon maturity. This is not a crisis of operations, but a crisis of mathematics. Assets capitalized during the ZIRP (Zero Interest Rate Policy) era of 2020–2022 were underwritten at capitalization rates that no longer exist. As the $1 trillion "Maturity Wall" arrives in 2026, senior lenders, constrained by stricter Debt Service Coverage Ratio (DSCR) requirements and Basel III regulatory capital controls, are offering refinancing proceeds that are often 20–30% lower than the maturing loan balances. This creates a "Refinancing Gap" that the existing common equity is unable to fill, necessitating the injection of external liquidity to prevent foreclosure.

Wall of Maturity:

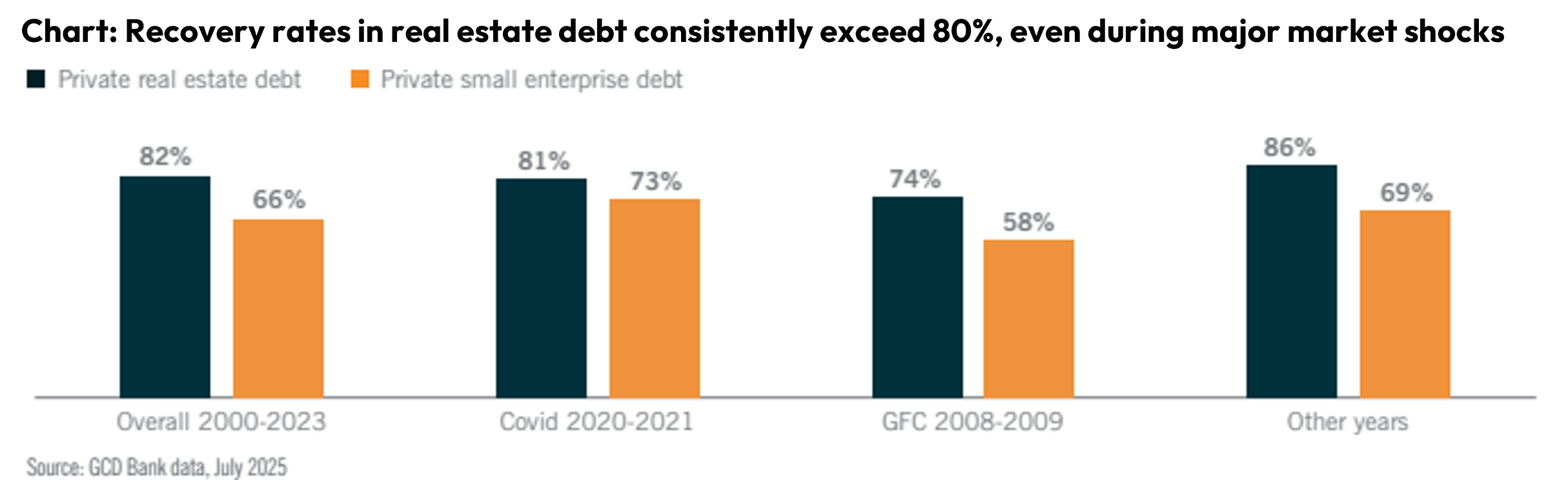

This frictional environment creates a distinct opportunity for Preferred Equity to serve as strategic "Rescue Capital." In this structure, we provide the essential gap funding required to pay down the maturing senior loan and bridge the asset to a stabilized, lower-leverage capital stack. Strategically, this instrument sits in a priority position within the capital hierarchy, subordinate only to the senior mortgage but senior to all common and general partner equity. Because this capital solves an existential threat for the sponsor (the total loss of the asset), it commands an institutional pricing premium, typically targeting 13–15% current pay yields with additional accrued interest (PIK) and exit fees. This return profile is structurally asymmetric: it offers equity-like yields while retaining debt-like covenants and fixed-income characteristics, effectively monetizing the sponsor’s urgent need to protect their sunk costs.

Crucially, the risk profile of this strategy may be mitigated by significant structural protections, most notably "Step-In Rights." In the event of a default or failure to redeem the preferred position at maturity, the preferred equity holder possesses the contractual right to remove the sponsor and assume full control of the property. This creates a "Loan-to-Own" optionality where the downside scenario involves taking ownership of a stabilized, cash-flowing apartment complex at a significant discount to replacement cost, often representing the "last dollar" of our basis at 65–70% of the asset's current market value. Consequently, the emphasis of partnering with "good owners" suffering from "bad balance sheets," providing them a lifeline while securing a position that offers defensive resilience through asset collateralization and offensive upside through high-yielding coupons.

The asset class benefits from low correlation with traditional investments, offering effective portfolio diversification. As banks retreat from lending due to Basel III regulations, alternative lenders continue to expand market share, creating a diverse and resilient lending environment.

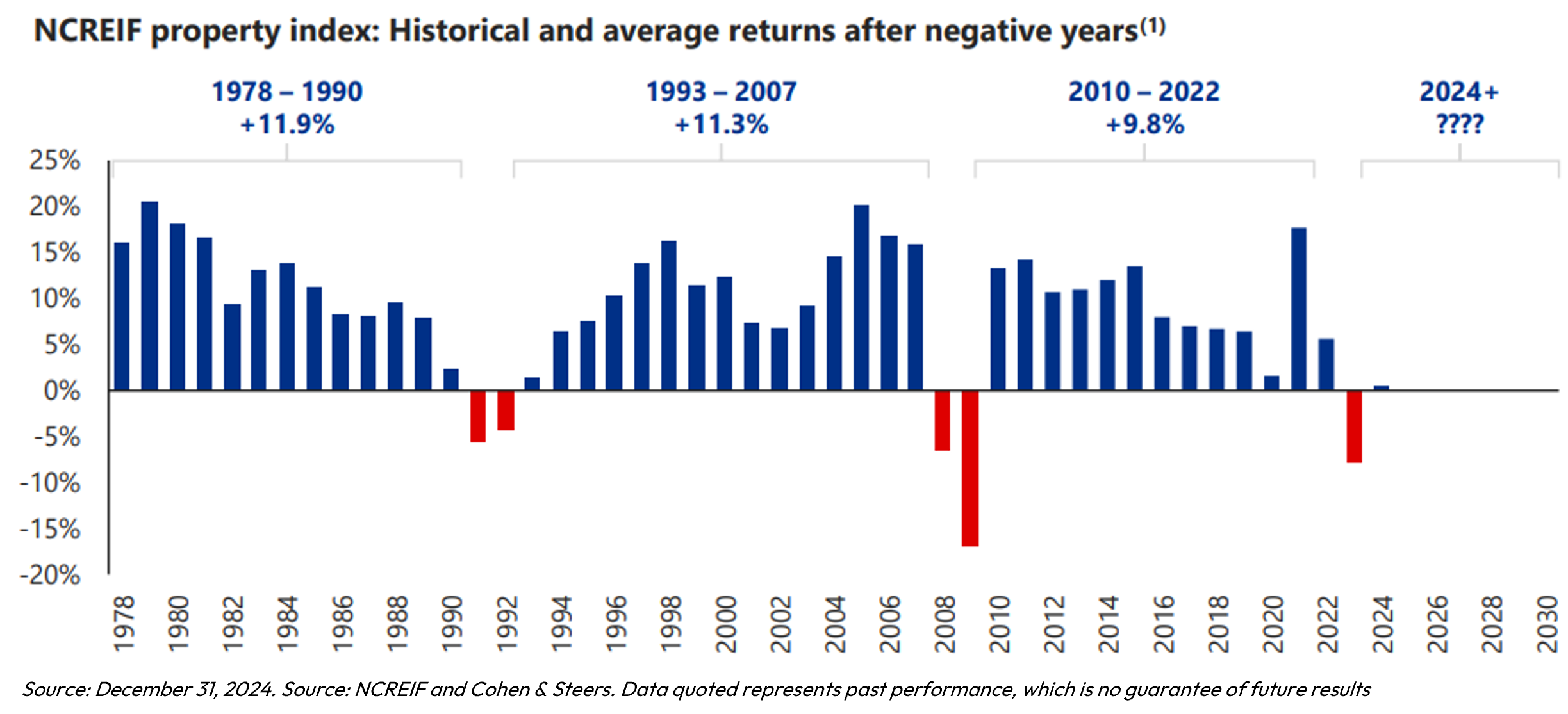

Taken together, these themes point to a 2026 and beyond vintage defined less by directional real estate beta and more by structural mispricing where the market is still anchored to outdated narratives (e-commerce kills retail; multifamily is “fine”) while the underlying constraints have inverted. On the asset side, the “unloved” retail complex, particularly grocery-anchored, service-heavy neighborhood centers now exhibits the characteristics institutional capital historically pays up for: scarcity of new supply, durable cash flows, and mission-critical utility as a last-mile and services platform. On the capital stack side, the multifamily opportunity is not predicated on betting against occupancy; it is predicated on monetizing a refinancing math problem created by higher rates and tighter lender proceeds, where preferred equity can be deployed at equity-like returns with debt-like structural protections.

The common thread is asymmetric underwriting: prioritizing positions where the investor is paid for providing something the market is temporarily short of entitled, well-located retail supply and bridge liquidity for otherwise viable multifamily balance sheets. In both cases, the path to returns is not dependent on heroic growth assumptions. Retail benefits from a likely normalization of cap rate spreads as capital rotates toward durable income at reasonable basis; preferred equity benefits from contractual priority, sponsor urgency, and control rights that harden downside outcomes while preserving upside.

In a resource-constrained, higher-for-longer environment, we believe the best risk-adjusted outcomes will accrue to investors who are early, selective, and structurally disciplined: acquiring retail where replacement is politically and economically prohibitive, and deploying rescue capital only where the asset is operationally sound, the basis is defensible, and governance provisions (including step-in rights) are non-negotiable. Executed properly, this is a portfolio construction opportunity that combines current income, embedded appreciation, and downside control—positioning early allocators to capture dislocation-driven alpha as the market reprices into 2026.

Theme 4: The Liquidity Barbell

Structural Arbitrage at the Intersection of Public and Private Markets

The coming years investment landscape may be characterized by a resurgence in corporate deal-making, driven by stabilized interest rates, restored CEO confidence, and the strategic imperative for industrial incumbents to acquire artificial intelligence capabilities. This revival of Mergers and Acquisitions (M&A) serves as the foundational engine for our "Liquidity Barbell" strategy which is a structural framework designed to exploit the pricing inefficiencies found at the intersection of public and private markets. Rather than adhering to the traditional dichotomy that views private markets solely as illiquid lock-ups and public markets as sources of beta, this approach bifurcates capital into two distinct, complementary temporal horizons: opportunistic entry into Private Equity Secondaries (long-term appreciation) and the harvesting of Merger Arbitrage spreads (short-term yield). This pairing allows the portfolio to capture a "liquidity premium" from distressed sellers while simultaneously harvesting "regulatory risk premiums" from complex public deal spreads

On the long-duration end of the barbell, the Private Equity Secondaries market presents a historic arbitrage opportunity driven by the "Denominator Effect" and a prolonged "Exit Drought." Following years of sluggish distributions, institutional Limited Partners (LPs) find themselves over-allocated to private asset classes and structurally liquidity-constrained. This imbalance allows tactical allocators to acquire high-quality, mature LP interests at potentially significant discounts to the Net Asset Value (NAV). Unlike primary private equity commitments, which suffer from the initial negative returns of the "J-Curve," (which essentially can be a long-duration period of investment loss until later years of investment realization/harvesting) secondary allocations offer immediate deployment into seasoned portfolios. As the M&A window reopens in 2026, these portfolios may be primed for realization events, allowing investors to benefit from a dual compounding effect: the natural appreciation of the underlying assets and the mechanical accretion of the discount closing to par upon exit.

Conversely, the short-duration component of the barbell utilizes Merger Arbitrage as a defensive "substitute." The current regulatory environment is anticipated to be less regulatory constrictive, formerly characterized by an aggressive antitrust scrutiny from the FTC and DOJ, has widened deal spreads to levels that imply significantly higher risk than fundamental analysis suggests according to McDermott, Will, and Schulte. By capturing the spread between a target company’s trading price and the acquisition offer, this strategy has historically generated annualized yields in the 8% to 10% range that are mathematically uncorrelated to the broader S&P 500. This return stream effectively functions as a high-yield, low-duration income proxy. By adding this Liquidity Barbell, the portfolio substitutes interest rate risk (duration) for idiosyncratic deal risk, with the goal of achieving a superior risk-adjusted return profile in a "higher-for-longer" rate regime.

Theme 5: Return of Alpha

The Death of "Set It and Forget It"

For a decade post-2008, passive investing outperformed active management as correlations were near 1.0 and asset prices were lifted by a rising tide of liquidity. In the high-dispersion, high-scarcity environment of 2026, where rates are higher and sectors are bifurcated between physical "haves" and "have-nots," we believe active management ("Alpha") will continue to add value. BlackRock explicitly states that "exposure to broad indexes is not a neutral stance" anymore. The dispersion between winners and losers is widening, thus creating opportunities for hedge funds and other liquid alternatives.

We operate under the conviction that this "Beta Supercycle", characterized by a rising tide of liquidity lifting all boats may be reaching points of structural exhaustion. The resilience of the market over the past three years has been remarkable. There are concerns that such low-volatility, unidirectional uptrends may not persist in perpetuity. Furthermore, the correlation between equities and fixed income remains elevated, rendering the traditional "60/40" portfolio vulnerable to simultaneous drawdowns. In an environment where the "easy money" of beta has been harvested, the marginal unit of return in 2026 may not be derived from market direction, but from manager skill-specifically, the generation of idiosyncratic alpha.

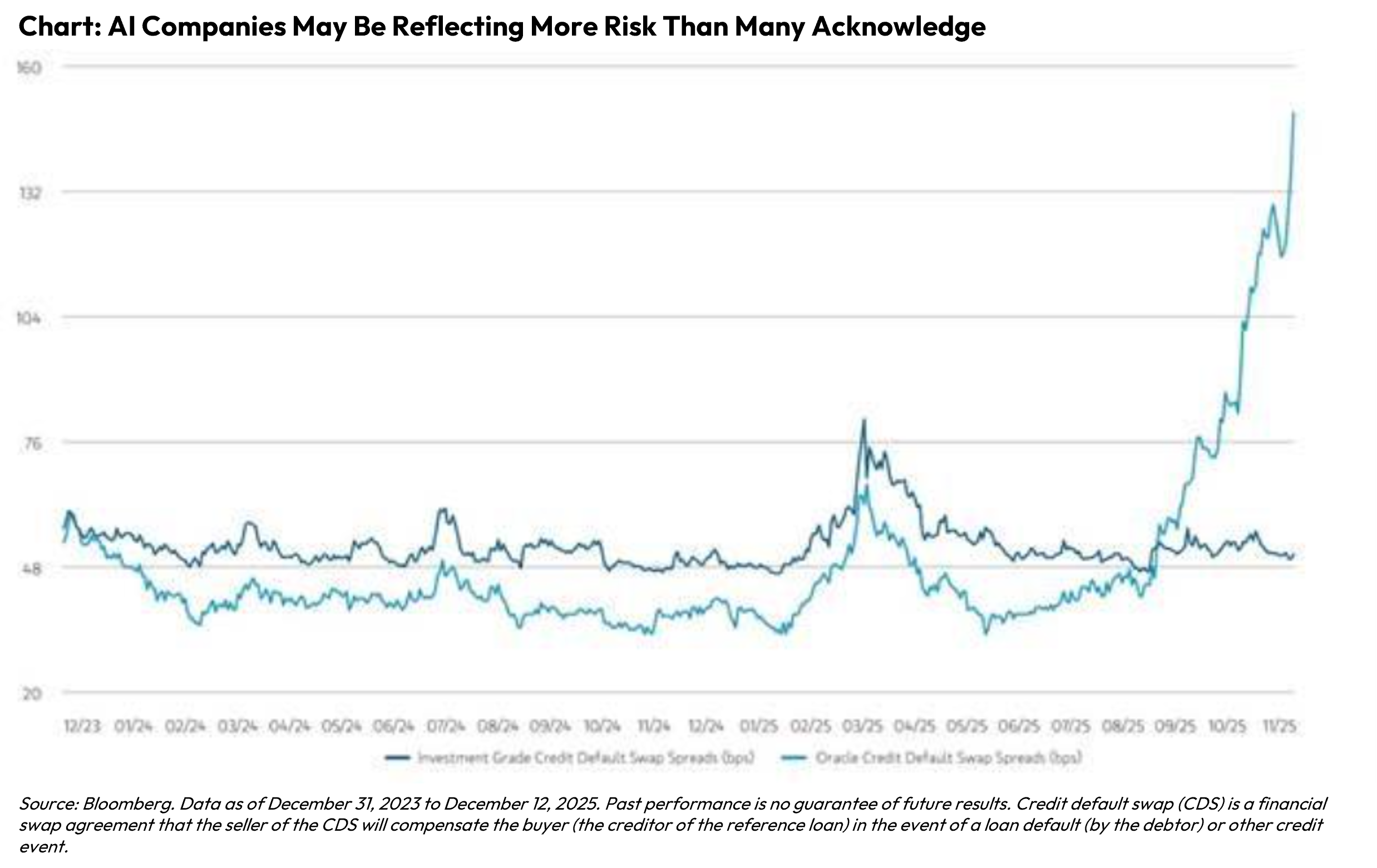

We are closely monitoring emerging cracks in the consensus narrative. From operational alarms such as the "Code Red" directive issued by OpenAI CEO Sam Altman regarding model improvements to the credit markets, skepticism is growing. Notably, Credit Default Swap (CDX) markets indicate that sophisticated debt investors may be growing weary of the leverage ratios utilized to fund the AI buildout. The market could ripen for a period of "Creative Destruction," where the divergence between the winners (who monetize AI) and the losers (who merely spent on it) becomes extreme.

In this scenario, the ability to short securities is not merely a hedging tool; it could potentially be a profit center. Long-only investors are structurally unable to capitalize on the mean reversion of overhyped equities. Hedge funds possess the unique convexity to monetize this shakeout.

To insulate the portfolio from broad market beta while capturing this dispersion, we advocate for a diversified allocation across three specific hedge fund sub-strategies:

Equity Market Neutral (Dispersion Capture) The correlation between individual stocks is falling. We are observing increased dispersion not just in the U.S., but across Europe and Asia, where diverging economic realities create rich hunting grounds for fundamental and quantitative analysis. We favor Market Neutral managers who strip out the direction of the market entirely. By pairing long positions in fundamentally strong cash-flow generators against short positions in unprofitable, hype-driven growth stocks, these managers can generate pure alpha regardless of whether markets move upwards or downwards potentially.

In addition, the relentless expansion of data and the transformative power of AI are reshaping the alpha generation landscape. As the data universe explodes, we believe systematic long/short strategies, equipped with advanced computing are uniquely positioned to synthesize this unstructured information. By extracting insights at scale, these managers can identify informational asymmetries on both sides of the book, spotting undervalued winners and deteriorating fundamentals ideal for shorting before they are fully priced in.

We believe quantitative long/short frameworks offer critical structural advantages for 2026 and beyond. Their systematic nature allows for dynamic control of gross and net exposure, ensuring that returns are driven by idiosyncratic stock selection rather than macro beta. By constructing market-neutral or hedged portfolios that isolate pure alpha, these strategies can generate consistent excess returns without taking on excessive directional risk. This ability to deliver uncorrelated performance makes data-driven long/short equity an imperative for investors seeking to protect capital while capturing upside.

Discretionary Global Macro (Policy Divergence) Discretionary Macro funds have been standout performers in 2025 and are poised for continued dominance. Central Bank synchronization is over. The Federal Reserve, the ECB, and the BOJ are likely to pursue divergent interest rate paths in 2026. This creates volatility in Foreign Exchange (FX) and Sovereign Rates markets. Macro managers thrive on these crosscurrents, capitalizing on geopolitical volatility and policy errors that passive equity algorithms cannot detect.

Managed Futures & Event Driven (Uncorrelated Convexity): Event Driven: With corporate confidence returning, capital markets activity is surging. We expect a sustained volume of M&A and spin-offs. Event Driven managers can harvest the "complexity premium" from these deals, locking in yields that are uncorrelated to the business cycle. As a final hedge, systematic trend-followers offer "crisis alpha", mechanically capturing trends in commodities and rates that serve as a buffer if the equity growth story stalls.

The 2026 environment requires a pivot from "Buying the Market" to "Trading the Market." By allocating to strategies that profit from friction rather than relying on the inertia of the index, investors can hopefully construct a portfolio capable of adding value whether the S&P 500 surges for a fourth year or corrects under the weight of its own success.

Conclusion: The Era of "Hard Assets" and "Hard Choices":

The transition to 2026 is a transition from the virtual to the visceral. The constraints are physical…power, labor, atoms, and national borders. The investment landscape has shifted from a world of abundance (cheap capital, cheap energy, cheap labor) to a world of scarcity.

For the investor, this requires a fundamental focus. Portfolios must move away from "blind beta" (broad indices) and toward "strategic alpha" (physical constraints and active management). The "easy money" era of software scaling with zero marginal cost is being replaced by an era of Industrial AI, where growth requires massive physical inputs.

The opportunities lie in the bottlenecks: the transformers that take three years to build, the metals that can’t be mined fast enough, the pipelines that cannot be replicated, the massive growth in the private markets and private companies backlogged by the lack of M&A and public offerings, and quantitative systems that can compute and synthesize information faster than ever before.

We continue to theorize on the "Return of Alpha", but we believe it may not be found in the places that worked in the last cycle. It may be found in the messy, capital-intensive, regulated, and critical sectors that keep the modern world and its digital twin running. The winners of 2026 may be those who can build, power, secure, and quantitatively drive forward in 2026 and beyond.

Works Cited:

1.KKR Global Macro & Asset Allocation, Flash Macro: U.S. FOMC March 2025, 2025.

2.BlackRock Investment Institute, 2026 Global Outlook, 2025.

3.BlackRock Investment Institute, 2026 Investment Outlook, 2025.

4.Visual Capitalist, Charted: The Shortage of U.S. Data Center Capacity (2023–2028).

5.Utility Dive, Transformer, breaker backlogs persist, despite reshoring progress, 2025.

6.Taishan Transformer, Global Transformer Price Trends and Market Insights 2025.

7.Wood Mackenzie, Power transformers and distribution transformers will face supply deficits, 2025.

8.Eaton Corporation, Eaton accelerates the transformation of data center infrastructure... with NVIDIA, 2025.

9.Eaton Corporation, Data center power demands amid energy transformation, Blog, 2025.

10.S&P Global Market Intelligence, Energy utility capex predicted to top $1 trillion from 2025 through 2029, 2025.

11.CoBank, Patchwork or partnership? 2026 will prove a pivotal year for grid governance, 2025.

12.Hamm Institute for American Energy, POWERING AI WITH AMERICAN ENERGY: NATURAL GAS, 2025.

13.Rextag, Natural Gas Fuels the AI Boom: Williams Builds the Backbone for Data Centers, 2025.

14.U.S. Energy Information Administration (EIA), Short-Term Energy Outlook, 2025.

15.Hennessy Funds, What's Driving Midstream Company Performance?, January 2025.

16.Natixis Investment Managers, 2026 Institutional Outlook: Markets dance to uncertainty, 2025.

17.Silicon Valley Defense Group, NatSec100 Report 2025, 2025.

18.JPMorgan Global Research, Copper Market Outlook 2026.

19.CoStar / Elyxium Internal Research, Retail Supply Deliveries Q3 2025.

20.BRG, Commercial Real Estate Maturity Wall Takeaways, 2025.

21.Bain & Company, Global Private Equity Report 2025, March 2025.

22.McDermott Will & Emery, Merger Arbitrage Spreads and Regulatory Climate, 2025.

23.Bloomberg Terminal Data, AI-Related Debt Issuance & CDS Spreads, Data as of Dec 2025.

Todd N. Golper is a CERTIFIED FINANCIAL PLANNER™ CERTIFIED PRIVATE WEALTH ADVISOR™, Head of Strategy and Alternative Investments of Elyxium Wealth, LLC, a Registered Investment Adviser that offers comprehensive financial planning, retirement planning, and investment management. Elyxium Wealth LLC (“the FIRM”) is a registered investment adviser located in Beverly Hills, California. The FIRM may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This presentations is limited to the dissemination of general information regarding the FIRM’s investment advisory services. Accordingly, the information in this presentation should not be construed, in any manner whatsoever, as a substitute for personalized individual advice from the FIRM. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise states, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Any client examples were hypothetical and used to demonstrate a concept.

Past performance is not indicative of future performance. Therefore, no current or prospective client should assume that future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the FIRM), or product referenced directly or indirectly in this presentation, will be profitable. Different types of investments or investment strategy are suitable for a client’s or prospective client’s investment portfolio.

The foregoing content reflects the opinions of Elyxium Wealth, LLC and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice, financial advice, tax advice, or legal advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions, or forecasts provided herein will prove to be correct. The above article was written with the assistance of artificial intelligence (AI).

INV-260112