Q3 2025 Macro Market Summary: A Quarter That Rewarded Diversification

Executive Summary

The third quarter of 2025 unfolded against a backdrop of tariff-induced volatility, rising long-term yields, and diverging equity market leadership. While U.S. equities staged a recovery from the April selloff, they lagged international markets, which benefited from currency tailwinds and stronger economic momentum abroad. Fixed income markets saw a steepening yield curve and renewed appetite for riskier credit, while higher-quality segments such as municipals and Treasuries underperformed. Meanwhile, tariffs reached their highest levels in nearly a century, reshaping growth and inflation expectations. Looking ahead, investors face a complex mix of elevated valuations in U.S. equities, attractive yields across global fixed income, and geopolitical risks that could weigh on sentiment.

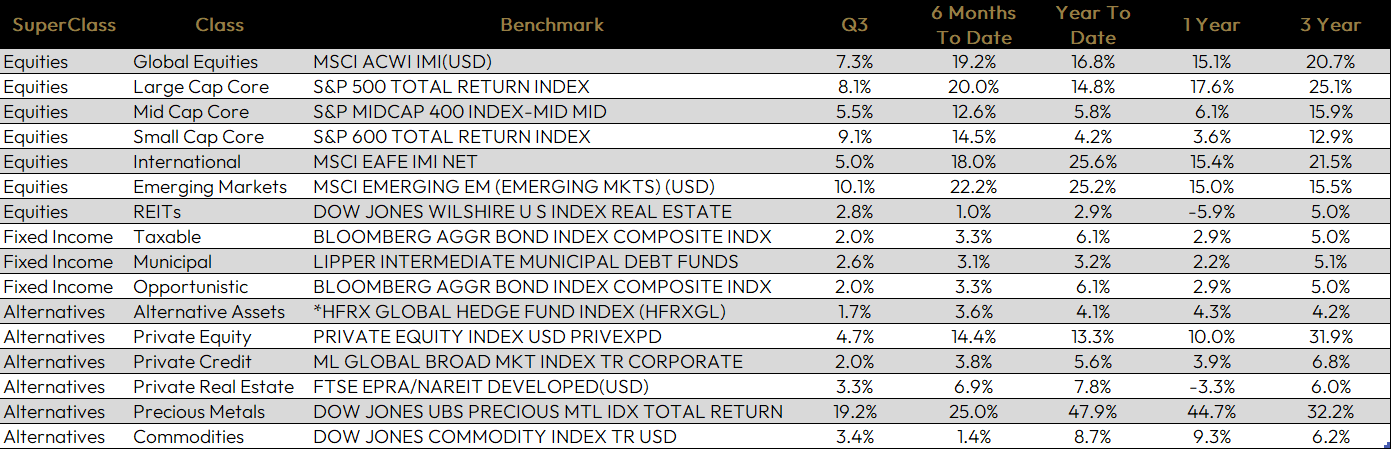

In spite of the headlines from the quarter, markets broadly delivered positive performance across asset classes. Global equities advanced 7.3% in the third quarter, led by a robust 8.1% gain in US large caps and a 9.1% rally in US small caps, as investor sentiment improved following tariff-related volatility. International and emerging-market equities also were strong performers, with the MSCI EAFE Index up 5.0% and the MSCI Emerging Markets Index surging 10.1%, aided by a weaker U.S. dollar and renewed capital flows into risk assets. Fixed income also contributed positively, with core bonds and municipal bonds each rising roughly 2%, supported by a stabilizing yield environment. Meanwhile, alternative assets—particularly precious metals—delivered standout results, as gold climbed over 19% for the quarter.

Data compiled via Black Diamond as of 9/30/2025; benchmarks sourced from MSCI, Bloomberg, HFRX, and Lipper. Indices are unmanaged and cannot be invested in directly. Index performance does not reflect the deduction of advisory fees, transaction costs, or other expenses associated with an actual investment. Past performance is not indicative of future results.

Equities

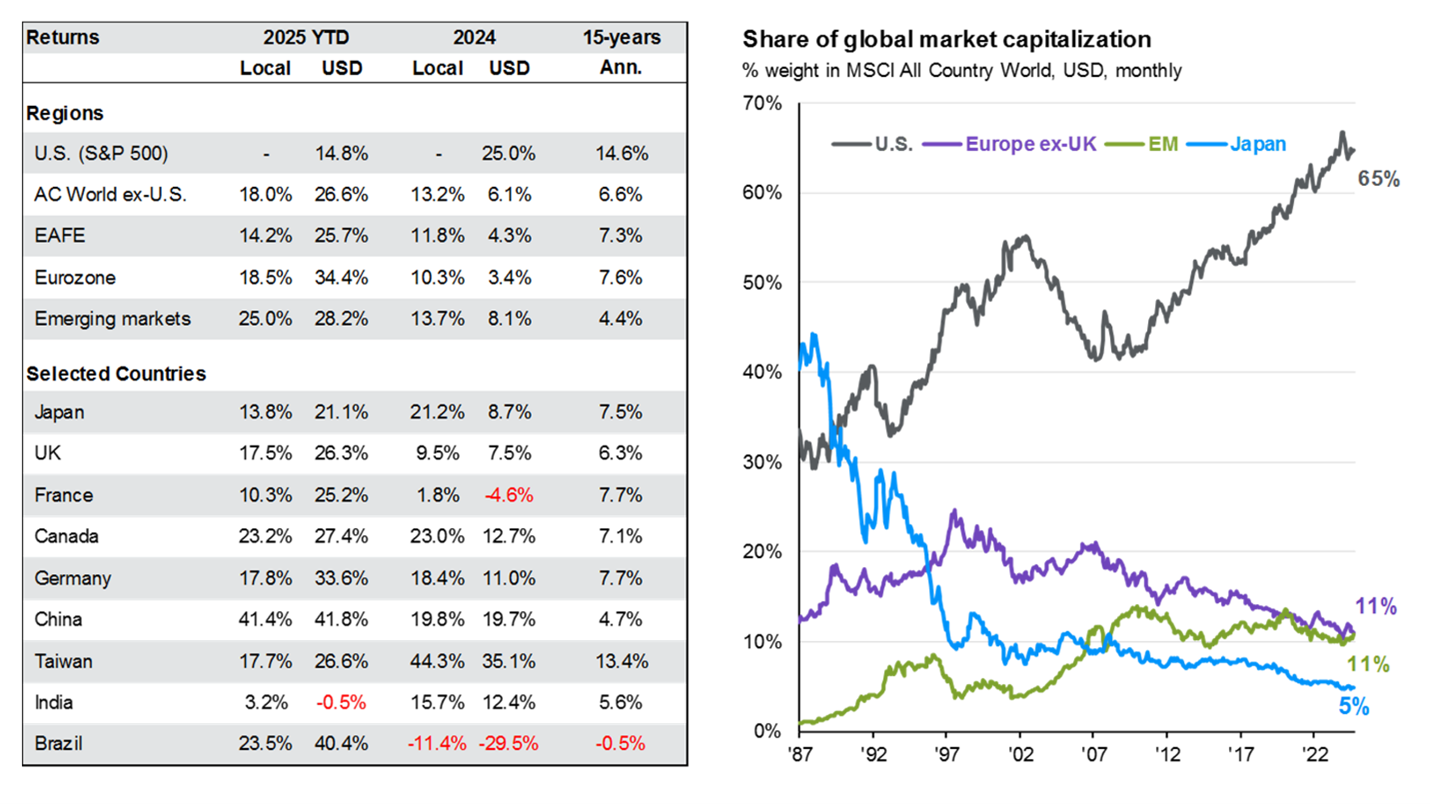

U.S. equities staged a rebound in the second quarter, with growth stocks—particularly the so-called "Magnificent Seven"—leading the way. Technology, communication services, and consumer cyclicals outperformed, while healthcare, real estate, and energy sectors lagged. Despite this recovery, U.S. equities remain behind developed markets ex-U.S. on a year-to-date basis. European equities delivered particularly strong returns, led by Spain, Italy, and Greece, while Latin America also posted robust gains. Emerging markets were more mixed, with Latin America outperforming but Asia showing pockets of weakness in markets such as Thailand and New Zealand.

Valuations remain a critical consideration in this performance comparison. The valuation gap between U.S. large caps and small caps persists, as does the discount of global ex-U.S. equities versus the U.S. Even emerging markets appear relatively attractive, with earnings multiples roughly 40% lower when compared to the U.S. In short, U.S. equities have regained stability after tariff shocks earlier this year, but international diversification has been rewarded in 2025, after about a decade of underperformance. We have taken steps this year to reduce our overweight to the US, recognizing that longer-term currency trends and more shareholder friendly policies overseas may finally be factored into stock prices.

Source: FactSet, MSCI, Standard & Poor’s, J.P. Morgan Asset Management. Data as of 9/30/2025. (Left) All return values are MSCI Total Return Index (Gross) data. 15-year history based on USD returns. 15-year annualized return figures are calculated using a rolling 12-month period ending with the previous month-end. Please see disclosure page for index definitions. Past performance is not a reliable indicator of current and future results.

Fixed Income & Credit

The fixed-income landscape in Q3 was marked by steepening yield curves and a global reach for yield. Long-term sovereign yields climbed to post-GFC (global financial crisis) highs, with the U.S. 30-year Treasury briefly breaching 5% before settling at 4.8%. Short-term rates drifted lower as markets priced in eventual Federal Reserve easing. This dynamic steepened the curve, widening the spread between short- and long-dated maturities.

Credit markets saw risk appetite return quickly after April’s tariff shock. High-yield bonds, leveraged loans, and emerging-market debt delivered the strongest returns, while municipals and higher-quality government debt lagged. Notably, credit spreads that had widened on trade volatility compressed back to historically tight levels, leaving valuations stretched and risk premiums thin. At the same time, overall yields across fixed income remain above their five-year averages, providing attractive income opportunities for yield-seeking investors.

Source: Federal Reserve Bank of St Louis. Data as of June 30, 2025

In the industry, flows have continued into short-duration and money market funds, as front-end yields remain compelling for investors seeking yield. Yet institutional allocators are increasingly considering longer-dated and riskier credit segments, balancing carry opportunities against concerns of a slowing global economy. At Elyxium we have followed that trend, as we recently added mortgage-backed securities into our taxable fixed income allocation. In contrast to the rest of the fixed income market, where spreads are at historically tight levels, the mortgage-backed securities segment is one area of the market where wider (than historical) spreads can be found. Prudent active management can allow clients to potentially generate higher returns while still having substantial downside protection.

Economic and Policy Backdrop

The dominant macro theme in Q3 was the resurgence of tariffs. U.S. average tariff rates surged to nearly 28% in April—the highest since the 1930s—before easing slightly to around 20% in July. Analysts from Morningstar revised down their U.S. GDP forecast by 0.7 percentage points for 2025–26, with cumulative growth expected to be 1 percentage point lower by 2029. Inflation forecasts were revised upward by 1.6 percentage points over 2025–26.

Globally, the IMF projects GDP growth of 2.8% in 2025, down from 3.3% in 2024, with the tariff impact largely concentrated in the U.S. and China. Europe has emerged as a relative bright spot, benefiting from a weaker dollar and recovering demand, while China faces export headwinds and a growing debt burden. The dollar’s decline in 2025, after its post-election surge in late 2024, has improved competitiveness for international markets and bolstered returns for U.S. investors holding foreign assets.

Housing markets in the U.S. remain resilient, with home prices up 4% year over year as of Q1 2025, though regional divergences are emerging. On the fiscal side, the U.S. debt trajectory remains troubling, with CBO projections showing debt-to-GDP climbing toward 156% by 2055 under current law.

Inflation trends added to the policy complexity. While headline inflation eased modestly in some categories, core pressures have proven sticky, with renewed acceleration outside of housing. Morningstar expects tariff-driven supply shocks to delay a return to the Fed’s 2% target, extending the timeline for disinflation by several years. Globally, inflation progress also stalled, particularly in Europe and the U.K., where energy and goods prices remain elevated.

Source: Macrobond Financial. Data as of June 30, 2025

Monetary policy expectations have adjusted only slightly despite tariff-induced uncertainty. Futures markets imply a gradual Fed easing path, but the central bank must navigate a delicate balance between supporting growth and containing tariff-driven inflation. Long-term market expectations anchor the 10-year Treasury yield at 3.25% by 2028, reflecting assumptions of a neutral rate of interest. As of this writing, the market is expecting another 25 basis point cut in October, a view we share.

Looking Ahead

Investors face a challenging backdrop entering the final quarter of 2025. Key themes include:

Tariff Policy: Further escalation or de-escalation of tariffs remains the most important swing factor for growth, inflation, and asset prices. A rollback could provide significant relief, while further escalation risks entrenched stagflationary pressures.

Valuation Divergences: U.S. equities remain expensive relative to history and global peers, while emerging markets and non-U.S. developed equities offer more compelling forward returns.

Fixed-Income Opportunities: Elevated yields across credit and sovereign markets offer attractive carry, but spreads remain tight and sensitive to growth shocks.

Policy Uncertainty: While the Federal Reserve and other central banks are likely to cut rates to offset slowing growth, policy will remain data-dependent and reactive to evolving inflation dynamics.

In this environment, investors may benefit from maintaining diversification across regions and asset classes, emphasizing relative value opportunities abroad, and taking advantage of elevated fixed-income yields while being mindful of stretched credit valuations. The balance between risk management and opportunistic positioning will remain paramount as markets digest a complex mix of policy, economic, and geopolitical forces.

Conclusion and Outlook

Equities have demonstrated resilience but continue to rely fairly heavily on a narrow group of U.S. growth leaders, while non-U.S. markets offer more balanced opportunities. Fixed income provides income potential not seen in years, as rates remain at attractive levels, though spreads highlight rich valuations. With tariffs reshaping the macroeconomic outlook, the next stage of the cycle will likely hinge on whether policy risks ease or intensify. The coming quarters call for flexibility and a willingness to lean into diversification, as the world contends with policy-driven uncertainty.

With all that said, we believe that risk assets should perform well in the short term, as this market has been broadening as it has moved higher. This backdrop suggests that further gains should likely lie ahead. We also like the earnings growth underpinning this global market and believe that with stronger earnings growth comes higher stock prices. We continue to be constructive on the backdrop in the fixed income market as higher yields offer the potential for higher returns at this part of the economic cycle. We will continue to be mindful of the risks that exist in this market and will adjust this view if necessary.

Elyxium Wealth LLC (“the FIRM ”) is a registered investment adviser located in Beverly Hills, California. The FIRM may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This presentation is limited to the dissemination of general information regarding the FIRM’s investment advisory services. Accordingly, the information in this presentation should not be construed, in any manner whatsoever, as a substitute for personalized individual advice from the FIRM. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Any client examples were hypothetical and used to demonstrate a concept.

Past performance is not indicative of future performance. Therefore, no current or prospective client should assume that future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the FIRM), or product referenced directly or indirectly in this presentation, will be profitable. Different types of investments involve varying degrees of risk, & there can be no assurance that any specific investment or investment strategy will suitable for a client’s or prospective client’s investment portfolio.

INV-251013