Mid-2025 Alternative Investment Outlook: Evolving Themes and Strategic Implications

“Imagination is the only key to the future. Without it none exists – with it all things are possible.”

Ida Tarbell

Introduction

The global investment landscape in mid-2025 finds itself at an inflection point. Six months ago, Elyxium Wealth’s January 2025 outlook anticipated a turning macro tide; central banks poised to ease after aggressive tightening, moderating inflation, and resilient structural growth themes in technology and infrastructure. Today, many of those expectations are materializing, albeit with nuanced shifts that refine our forward view. Inflation has indeed receded from its 2022 peaks, enabling a tentative start to monetary easing in certain economies, though policy paths remain divergent. Financing conditions have slightly improved as rate hikes paused or reversed, offering relief to interest-rate-sensitive assets. Meanwhile, geopolitical tensions persist (from protracted conflict in Eastern Europe to US-China trade frictions), continuing to reshape supply chains and capital flows. These crosscurrents such as easier money, lingering inflation risk, and geopolitical realignment set the stage for our updated mid-2025 alternative investment outlook.

By and large, the five core themes identified in January we set out: AI & digital infrastructure, core infrastructure, hedge funds, GP stakes, and real estate have proven prescient. The transformative power of AI has, if anything, accelerated beyond early-year expectations, driving even greater investment and resource demand. Infrastructure’s defensive appeal and growth underpinnings remain firmly intact, though the balance of opportunities has shifted subtly with the macro climate. Hedge funds have flourished amid 2025’s volatility, validating their role in a new market regime. GP stakes continue to ride the secular expansion of private markets, despite a more selective deal environment. Real estate has been a tale of two markets: Residential and industrial assets are rebounding as predicted, but office properties face even deeper challenges than anticipated. In place of the summary tables from the January outlook, we provide below a narrative synthesis of what has changed between January and July 2025, and how those developments are shaping expectations for the second half of 2025 and into 2026. The message to investors and our partners is clear. The themes are intact, but strategic positioning and risk management must adapt to mid-year realities. Let’s examine each theme in turn, incorporating the latest data and forward-looking analysis.

AI and Digital Infrastructure: Surging Demand, Strained Supply

AI Boom Accelerates: 2025 has so far confirmed and amplified the transformative impact of artificial intelligence across industries. At the start of the year we projected the global AI market to exceed $1 trillion by 2027; those lofty growth estimates remain on track or may prove conservative as adoption accelerates. Corporations in sectors from finance to healthcare have raced to deploy generative AI and machine learning tools in production workflows, spurred by competitive pressures to boost productivity. Investor enthusiasm also stayed robust – public equity markets saw AI-focused companies command premium valuations in H1 2025, and private investment in AI infrastructure (from semiconductor chips to software startups) continued at a strong clip. In short, the “AI & automation” thesis we highlighted in January has only gained momentum by mid-year, reinforcing our conviction that this is a durable, multi-year trend rather than a passing tech fad.

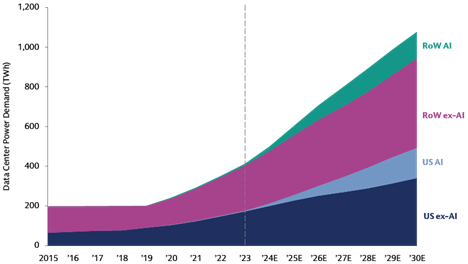

Digital Infrastructure Under Strain: The breakneck growth of AI is not coming free of bottlenecks. A critical mid-2025 development is the growing strain on digital infrastructure – particularly data centers, power grids, and networks as AI’s hunger for computational power soars. Training advanced AI models and processing vast datasets require enormous energy and bandwidth. Data center operators are now grappling with power and cooling constraints that were only abstract concerns a year or two ago. Notably, NVIDIA’s latest AI chips consume up to 300% more power than their predecessors, and industry forecasts suggest global data center energy demand could double in the next five years according to JLL. This surge has made electrical power a strategic resource: regions with available electricity and robust grid infrastructure are seeing a boom in data center construction, whereas projects in power-constrained areas face delays. In fact, utilities and developers report multi-year waits for new high-capacity power hookups which is a stark change from the recent past. The industry response has included exploring unconventional solutions like on-site generation and even small-scale nuclear reactors for data centers, underscoring how critical power security has become.

U.S. electricity consumption is now forecast to rise more steeply through 2026 than previously expected, as AI adoption fuels data center demand. The U.S. Energy Information Administration’s latest outlook (June 2025) projects total power usage reaching ~4,193 billion kWh in 2025 and ~4,283 billion kWh in 2026, up from a record ~4,097 billion kWh in 2024. Much of this growth is attributed to expanding commercial sector usage with data centers in particular causing the EIA to revise its demand forecasts markedly higher. Notably, data centers consumed an estimated 4.4% of U.S. electricity in 2023 and could account for as much as 12% by 2028 at current trajectories.

The chart above illustrates the upward revision in U.S. power consumption expectations, which carries important implications for investors. First, the surge in electricity demand highlights investment opportunities in power generation and grid infrastructure. Renewable energy projects, battery storage, and grid upgrade initiatives stand to benefit as public and private sectors race to ensure sufficient capacity. Second, it reinforces the attractiveness of data center real estate and digital infrastructure assets with these facilities are running near full capacity and commanding higher rents/pricing due to scarce power and space. Indeed, data center occupancy and deal activity in 2025 are at record levels as cloud providers and hyperscalers secure more capacity. However, investors must also recognize that this high demand environment can compress yields; competition for quality data center assets is intense which puts concern on entry valuations on new investments. We continue to favor strategies that partner with experienced operators to develop new capacity (where yields may be higher), and those that invest in enabling technologies (such as advanced cooling systems or energy efficient chips) that alleviate the infrastructure strain.

Source: Cisco, IEA, Masanet et al. (2020), Goldman Sachs Global Investment Research as of June 4, 2025

Forward Looking Assessment: Going into H2 2025 and 2026, we maintain a constructive but selective stance on AI and digital infrastructure. The secular drivers of AI’s exponential growth in enterprise use and consumers’ digital consumption are firmly in place. Yet the mid-2025 developments underscore a need for nuance. Liquidity planning is important here: the capex intensive nature of digital infrastructure means some investments (e.g. new data center construction or fiber network rollouts) may have significant cash outlays before yielding returns. LPs should ensure their allocation to these illiquid projects is sized appropriately and consider vehicles that provide interim cash yield (such as data center REITs or income-generating digital infrastructure funds) to balance the more development-oriented plays. Macro sensitivities around energy are also a factor higher electricity prices or rationing in certain regions could impact data center profitability. We thus emphasize geographical and regulatory diversification (favoring regions with supportive energy policy or abundant renewables). The bottom line is that AI-driven digital infrastructure remains one of the most compelling themes for long-term growth. Mid-2025 has, if anything, strengthened the case but it has also reminded us that execution (securing power, managing costs) will likely determine winners and losers. We recommend institutional investors continue to overweight this theme, while closely monitoring capacity constraints and advocating for sustainable energy solutions that enable its growth.

Core Infrastructure: Resilience in a Shifting Macro Climate

Defensive Characteristics Confirmed: Core infrastructure assets like transportation, utilities, energy midstream, and communications networks has lived up to its reputation as an “all-weather” asset class in the first half of 2025. Even as public equity and bond markets swung through volatility, core infrastructure portfolios delivered stable cash flows and inflation-linked revenue growth. Our January outlook highlighted infrastructure’s attractive risk-adjusted returns and inflation hedging in a regime of still-elevated price levels. Indeed, that thesis has held: many infrastructure assets (e.g. toll roads, regulated utilities) saw revenues climb in line with inflation-indexed tariffs or higher usage, while their valuation multiples benefited from the stabilization of interest rates. By mid-2025, the interest rate environment has shown limited improvement. Policy rates in the U.S. have come off their peaks slightly and credit spreads narrowed as recession fears ebbed which has eased some pressure on core asset valuations. While we are not yet in a full fledged rate cutting cycle, the directional shift (from tightening to pause/easing) has improved investor sentiment toward infrastructure. In fact, fundraising for infrastructure strategies picked up considerably in H1 2025, after a cautious 2024. Large institutional allocators that had been underweight are now seeking to deploy capital into the asset class, drawn by its combination of yield and secular growth angles.

Source: Preqin (fundraising), EDHEC (valuations). As of December 2024. EV/EBITDA median over the past 5 years. Fundraising for 2022-2024. Large cap defined as fund size >$8bn; midcap defined as fund size $2-$8bn.

Evolving Opportunity Set: From Core to Core-Plus: Mid-2025 macro dynamics have slightly altered where we see the best opportunities within infrastructure. With real interest rates still relatively high, purely bond like core assets (e.g. fully regulated utilities or contracted renewables) have seen their equity valuations recover only modestly with their defensive income is valuable, but upside is capped if rates stay higher for longer. In contrast, core-plus and value-add infrastructure assets with some economic sensitivity or operational improvement potential are more intriguing now. We believe fundamental growth should be a bigger driver of returns going forward, as multiple expansion from falling rates is not a given. This argues for focusing on infrastructure investments that can grow earnings, not just clip coupons. Examples include mid-market digital infrastructure companies that can scale up (data tower and fiber operators expanding coverage) and transportation assets that benefit from volume rebounds. As Goldman Sachs observed in a recent mid-year outlook, middle-market infrastructure offers a compelling mix of value creation levers, especially as large-cap infrastructure valuations remain at a premium.

Outlook for H2 2025 and 2026: We enter the back half of 2025 with a constructive outlook on infrastructure, tempered by careful asset selection. Macro expectations are that interest rates will gradually decline over the next 18 months (though likely not in a straight line), which should provide a tailwind for infrastructure valuations and allow more refinancing/recapitalization activity. That said, we don’t rely solely on multiple expansion for returns; we seek assets where cash flow growth should drive value. Sectors like energy transition infrastructure (renewables, energy storage, transmission) and communications infrastructure (towers, fiber, small cells) fit that bill, supported by secular demand. We are slightly warier of ultra-core, low-growth assets in a potentially “stickier inflation” world – those should be balanced with allocations to infrastructure businesses that have GDP-linked or volume based growth. Secondary market activity has been increasing for infrastructure fund interests, which can be an avenue for LPs to adjust exposures if needed. Geopolitical sensitivities also warrant attention: infrastructure assets are exposed to political/regulatory risk (e.g. windfall taxes or tariff changes). Diversifying across jurisdictions and favoring markets with stable regulatory frameworks will be important. In summary, core infrastructure remains a cornerstone of our alternative allocation. Its performance through the volatile first half of 2025 reinforced its role as a stabilizer. We recommend that investors maintain a strong core infrastructure allocation, while tilting slightly toward growth oriented infrastructure sub-sectors and ensuring they partner with managers who have operational expertise to drive value in this evolving landscape.

Hedge Funds: Navigating the New Market Regime

Strong Performance in a Volatile Environment: 2025 has so far been a showcase year for hedge funds, validating our thesis that we have entered a more favorable regime for active, skill based strategies. The first six months of the year were characterized by choppy equity markets and shifting macro signals from bank sector jitters and uneven growth data to rapid rotations between market leadership. Broad market returns were modest and accompanied by spikes in volatility. Hedge funds, in aggregate, have capitalized on these conditions. Industry data indicates that hedge funds outperformed a traditional 60/40 equity/bond portfolio both year-to-date and over the past several years. As quantitative easing has given way to quantitative tightening and higher dispersion, many hedge funds have generated true alpha, not just beta masquerading as skill. Strategies that we highlighted in January. Global macro, equity long/short, and multi-strategy have delivered on cue, taking advantage of macro volatility and security dispersion. For example, global macro funds profited from divergent central bank moves (long U.S. duration as the Fed signaled a dovish tilt, short Yen as Japan maintained yield curve control, etc.), while equity long/short managers benefited from stark valuation gaps that opened up between, say, AI-driven tech stocks and lagging cyclical stocks. The result is that hedge funds provided both downside protection and opportunistic gains in H1 2025 a welcome development for investors after the lean years of the 2010s.

Differentiation and Manager Selection Matter: A key mid-2025 observation is that not all hedge funds are thriving equally. The dispersion between managers has widened, underscoring the importance of diversification and manager skill. Notably, the large multi-strategy hedge funds (the multi-PM platforms that grew rapidly over the past decade) have seen some performance normalization. They remain important players, but increased competition and higher financing costs have made it harder for them to consistently top the charts. In fact, over the past three years, the multi-strats have only been middle-of-the-pack performers, while certain specialized strategies like quantitative equities have led with positive annualized alpha. The implication for investors is clear: one should maintain a portfolio of hedge fund managers across different styles (macro, quant, fundamental equity, credit, etc.), as this enhances diversification and increases the probability of capturing the winners. We continue to see value in multi-strategy funds for their breadth, but allocating too heavily to one firm or one style could be suboptimal. Instead, casting a wide net including nimble single-strategy managers and newer entrants can improve risk-adjusted results.

Forward Looking: Role in the Portfolio: As we head into H2 2025, we remain positive on hedge funds as a core portfolio diversifier and opportunistic alpha source. The macroeconomic regime characterized by “higher for longer” interest rates, persistent (if moderating) inflation, and periodic growth scares is fundamentally different from the low-vol, high-liquidity 2010s. That previous era had compressed many arbitrage opportunities and left hedge funds struggling for alpha. Now, with genuine dispersion back, we expect alpha generation to stay strong. We advise investors to maintain (or even modestly increase) their strategic allocations to hedge funds, ensuring those allocations are spread across complementary strategies Constructing a balanced hedge fund program that can weather multiple scenarios is the goal.

In summary, 2025 has reaffirmed that hedge funds “do what they’re supposed to do” in volatile times…they have added value and protection. As one Goldman Sachs analysis noted, hedge funds have performed especially well in this regime and continue to justify their role, as long as investors commit to careful manager selection and style diversification. For institutional LPs, the takeaway is to lean into this space opportunistically: ensure your roster of managers is high-conviction, monitor their exposures actively, and don’t shy from rotating or rebalancing among strategies as conditions evolve. Hedge funds are dynamic allocations, and that dynamism is precisely what makes them valuable in a dynamic world.

GP Stakes: Strategic Capital in an Expanding Alternatives Universe

Growth of Alternatives Continues: The GP stakes theme of taking minority ownership in private asset management firms remains a compelling long-term strategy, supported by the continued expansion of the alternatives industry. Despite a more challenging fundraising climate in 2024 and early 2025, the overall trajectory of private markets is upward. Global allocations to alternative assets (private equity, private credit, real assets, etc.) are still on pace to grow from $25 trillion in 2022 to an estimated $60 trillion by 2032, driven by institutional investors’ search for yield and diversification beyond public markets. In the first half of 2025, many institutional LPs actually reaffirmed or modestly increased their target allocations to alternatives, even if the pace of capital deployment was measured. This matters for GP stakes because as the AUM of top-tier managers grows, the value of owning a slice of those management companies grows as well. Our January outlook cited the historical outperformance of private equity and the steady fee income streams that make GP stakes attractive…those factors are intact. If anything, the current environment has made fee-related earnings (FRE) from asset managers more valuable as a stable, recession-resistant income source, at a time when transaction-based income (like deal carry or realizations) has been delayed by slower exit markets. GP stakes investors typically receive a share of these management fees (often 1–2% of AUM) and performance fees, giving them a cut of both the base earnings and the upside when funds eventually monetize gains. In H1 2025, with fewer exits, the FRE component has dominated highlighting the appeal of GP stakes as a steady cash generator in interim periods.

Mid-2025 Market Dynamics: Over the past six months, we have seen some shifts in the GP stakes landscape. Notably, valuations for GP stake transactions have become more reasonable compared to the frothy levels of 2021. During the peak of the private equity boom, minority stakes in top GPs were often priced at 20–25x earnings or more. Now, after the 2022–2023 market correction, entry multiples are somewhat lower. This reflects both a normalization of expectations and the fact that some GPs faced fundraising headwinds and were more willing to accept capital at a sensible price. For GP stakes investors, this is positive. It means new deals can be struck with better alignment and upside. We observed in early 2025 a few notable GP stakes deals: for example, stakes in a leading private credit firm and a real estate investment manager changed hands, reportedly at discounts to the valuations those firms commanded a couple years prior. These transactions indicate that the deal pipeline is active but disciplined. It’s also worth noting that GPs are selectively seeking strategic capital: some mid-sized managers desire GP stake partners who can help institutionalize their business or expand distribution, not just provide cash. This aligns with our outlook that GP stakes can bring strategic partnerships. The GP stake buyer often offers advice on scaling, governance, or product development, which ultimately benefits both parties.

Expectations and Strategy Ahead: We remain positive on GP stakes as a niche within alternatives, but investors should approach it with clear eyes on liquidity and concentration risks. GP stakes investments are highly illiquid, one is essentially locking up capital in a privately held management company possibly for a decade or more. Thus, from a liquidity planning perspective, only investors with a long horizon and sufficient liquidity elsewhere should allocate to this strategy. It often makes sense as a small slice of the portfolio for those with large alternative buckets. That said, the mid-2025 landscape has somewhat derisked new GP stakes commitments: valuations are a bit lower, and the GPs seeking capital tend to be those with solid fundamentals who want support to accelerate growth (as opposed to distressed managers).

One macro sensitivity to note is interest rate and market level impacts on GP economics. A sharp market downturn or prolonged high-rate environment could slow AUM growth or compress profit margins for asset managers (for instance, if performance fees stay below high-water marks for longer). This would in turn slow the cash flows to GP stake investors. Conversely, a market rally that boosts asset values would swell AUM via appreciation and likely lead to performance fees, benefiting GP stake holders. Essentially, GP stakes have a beta to the alternatives industry cycle though a lower beta than a direct PE fund investment, it’s not immune to cycles. We saw this in 2020: even as deal activity paused, management fees largely kept accruing, cushioning GP revenues. We take comfort that many leading GPs have diversified platforms (private equity, credit, infra, etc.), which provides some resilience…a downturn in one asset class might be offset by strength in another (e.g. private credit is booming even when buyouts slow).

For institutional LPs, our guidance is to position GP stakes as a strategic, long-term holding that can yield steady income and participation in the growth of alternatives. It complements direct fund investments by essentially “investing in the house.” However, careful due diligence is paramount, assessing the quality of the GP’s franchise, its competitive edge, and succession plan (since you’re often tying up capital beyond the current leadership’s tenure) is critical. We favor GP stakes in multiproduct, scaled firms that have strong brands and sticky investor relationships, as these are positioned to grab disproportionate share of the $60T alternative AUM expansion. In conclusion, mid-2025 developments have only reinforced the long-run attractiveness of GP stakes. The thesis of “investing in the managers” stands firm, and current conditions offer a more favorable entry point and partner dynamic for LPs looking to deploy capital into this area.

Real Estate: Pockets of Strength Amid an Office Reckoning

Mixed Recovery Trajectory: The U.S. real estate market in 2025 is proving to be a story of two divergent tracks. As anticipated in January, residential and industrial real estate have entered a recovery/expansion phase, while the beleaguered office sector has further deteriorated, even more than many expected. Let’s start with the positive developments. Following the late 2023 bottoming of values, core real estate prices in sectors like multifamily apartments and modern industrial/logistics facilities have seen a mild rebound through mid-2025. An initial drop in interest rates (long-term yields are down from their 2022 highs) provided a tailwind for cap rates, and strong tenant demand especially for rental housing has driven improved operating performance. National apartment occupancy rates have held up in the mid-90s% and rent growth, while slower than the feverish pace of 2021, remains positive in most markets. This is underpinned by demographic tailwinds and a structural housing shortage. As predicted, 2024 delivered a surge of multifamily completions, but by mid-2025 the glut is easing. New construction starts dropped sharply when rates spiked, so supply is now tapering. Markets that were soft last year (e.g. Austin, Phoenix, other high-growth Sunbelt cities) are already seeing rent concessions burn off and absorption of new units picking up. We expect late 2025 into 2026 to show clear rent reacceleration in residential as the supply demand balance tightens again. This validates our view that residential rental real estate would be resilient; it has been among the first sectors to bounce back, and investors who bought in late 2024 or early 2025 at discounted prices are now seeing valuation upticks.

The industrial/logistics sector likewise is charting a favorable course. The unprecedented warehouse demand of 2020–2021 (driven by e-commerce and supply chain reconfiguration) cooled in 2022, but did not reverse. Vacancy rates nationally stayed low (sub-5% in many logistics hubs) and rent growth merely normalized. With new warehouse construction starts dropping in 2024 due to higher financing costs, the stage is set for a renewed landlord’s market. Mid-2025 data already show positive absorption in key distribution markets, and tenants are back in expansion mode as they adjust to post pandemic inventory strategies. We expect the second half of 2025 to bring a more pronounced shortage of quality industrial space, allowing property owners to push rents again. Investors are responding by targeting industrial assets and even exploring conversions of other property types to last mile distribution where feasible. Additionally, niche sectors like life sciences labs and data centers (overlap with digital infra) have their own dynamics but generally benefit from high user demand though life sciences real estate has seen a pause in leasing as the biotech funding cycle slowed, the long term outlook in innovation clusters remains positive.

Shifting Expectations and Strategy: Given this divergent backdrop, how should institutional investors position in real estate for the remainder of 2025 and beyond? Our view is to lean into the strength while surgically picking through the weak spots for opportunity. In practical terms, that means: prioritize residential and industrial exposure as these are the sectors with solid fundamentals and improving outlooks. For residential, we particularly like workforce housing and single family rental strategies, as affordability pressures keep many Americans renting (demand is robust, and these segments have defensive characteristics). For industrial, logistics facilities in high barrier markets and small infill warehouses (“last mile” distribution) are attractive, as they cater to enduring ecommerce and supply chain trends.

We also see merit in real estate credit/debt strategies at this juncture. With banks pulling back, private lenders can negotiate favorable terms on senior loans to quality properties. For example, providing mezzanine financing to a strong multifamily portfolio at a moderate loan-to-value can yield equity-like returns with debt-like downside protection. Such credit plays can be a way to gain exposure to rebounding sectors while mitigating some volatility.

In the troubled office segment, we recommend extreme caution but not complete avoidance, because dislocation can breed opportunity. The key is selectivity and pricing. Only the highest quality, modern office buildings in prime locations (the top 10-20% of stock) are worth considering, and even then, only at deeply discounted prices that account for future capex and leasing risk. There may be scenarios in 2026–2027 where buying a well-located office at a fraction of replacement cost yields outsized returns if the building can be repurposed or leased to new-economy tenants. However, this is a speculative investment framework; it should be a small, opportunistic slice for those with specialist teams. Broadly, we anticipate office capital values will take several years to find a floor, and many debt maturities in 2025/26 will require restructuring. Liquidity planning is crucial here as investors dabbling in office distress must have patient capital with no near-term need for liquidity, as the hold period to realize turnaround value is uncertain.

Source: NCREIF. NPI is the National Council of Real Estate Investment Fiduciaries Property Index. You can not invest in an index. Index data does not reflect the deduction of fees and other expenses which would reduce returns. Past performance is not indicative of future results.

On the macro sensitivity front, real estate is obviously tied to interest rates. If inflation flares up again and bond yields rise, that could stall the recovery in real estate values – a risk to monitor. Conversely, a sharper-than-expected economic slowdown would hurt occupancy and rent growth (though it might bring lower rates sooner). We are moderately confident that the base case: a continued economic expansion at a modest pace with gradually easing rates will play out, which is a favorable scenario for most real estate (again, excluding possibly offices). Yet, investors should stress test their real estate portfolios under tougher scenarios (e.g. a recession) to ensure they could handle temporary valuation drops or funding capital calls for any value-add projects.

Finally, in terms of portfolio role: real estate remains a critical component of an alternatives allocation, offering income, inflation hedging, and diversification. The lesson of 2025 so far is dispersion: sector and asset selection drive outcomes.

In conclusion, our mid-2025 real estate outlook is cautiously optimistic for the right segments and clear-eyed about the challenges in others. Real estate is inherently local and idiosyncratic, but the broader themes we identified – a nascent expansion cycle in living and logistics, and a painful shakeout in office – are unfolding. We advise LPs to position accordingly: focus on the sectors in secular demand, be prepared to deploy capital into distress selectively, and keep some dry powder available because the next 12-18 months could present fantastic buys as the market sorts itself out. By balancing caution with agility, investors can navigate this complex landscape and emerge with portfolios geared for sustained growth.

Conclusion: New Secular Horizons in Alternative Investing

As institutional LPs look beyond early-2025’s familiar playbook, several newly emerging secular themes are coming to the forefront. These trends which are largely underemphasized at the start of the year are now shaping long-horizon opportunities (3–5+ years) and redefining where and how alternative capital will be deployed. In our view, these are enduring shifts rather than tactical trades, reflecting structural changes in the investment landscape. Key themes include:

Disruption Megatrends and Economic Security: The interplay of macro disruption and technological change is spawning cross-asset investment themes that demand long-term focus. Heightened geopolitical tensions, trade shifts, and the rise of AI are creating secular investment needs across supply chains, energy, and defense. We see economic security. From localized supply chains to resource independence – becoming a foundational theme for alternatives. Goldman Sachs Asset Management (GSAM) emphasizes that companies and governments are prioritizing supply chain resiliency, critical resource access, and cybersecurity, opening avenues for private capital to finance these projects. These drivers, paired with sustainability goals, are fundamentally sound and still in early innings suggesting a multi-year runway for investments in sectors like advanced manufacturing, critical minerals, and defense-tech infrastructure. By identifying opportunities at the intersection of security and innovation, long-term investors can position portfolios for resilience and growth.

Mainstreaming of Digital Assets: What was once a niche digital asset space is rapidly entering the institutional mainstream. Corporate and institutional interest in blockchain-based assets has accelerated, fueled by broader market maturation and a wave of regulatory clarity that is moving the ecosystem from theory to real-world adoption. For example, clearer rules around crypto custody and stablecoins in 2025 have given investors newfound confidence to engage. Stablecoins have emerged as one of the fastest-growing segments, enabling cross-border transactions at internet speed and negligible cost – a tangible improvement over traditional payment rails. As this evolution shifts from “Why invest in digital assets?” to “How do we integrate them?”, capital markets activity is picking up. Notably, digital asset M&A volumes reached nearly $16 billion in 2024 (up from just $1 billion in 2019), signaling a consolidation of platforms and services. Going forward, we anticipate a convergence of traditional finance and crypto: major financial institutions are partnering with or acquiring crypto innovators, and tokenization of real assets is unlocking new liquidity channels. This convergence alongside rising investor demand for access is creating strategic opportunities for early movers to bridge decentralized technology with traditional asset management. The window for early-mover advantage remains open, as many institutional portfolios are still under-allocated to digital assets relative to their potential. We believe patient capital can capitalize on this gap, treating digital assets (and the infrastructure behind them) as a long-horizon allocation theme rather than a speculative trade. Elyxium participated in this notion with investing in Bitcoin in mid May for our clients.

Source: RWA.xyz’s “Total RWA On-Chain” dashboard and its 2024 year-end report

Private Secondaries as a Strategic Liquidity Tool: The private equity secondary market has evolved from a cyclical afterthought into a secular opportunity for liquidity and alpha. Year-to-date in 2025, secondary fundraises have surged with total capital raised in the first half is already 60% of 2024’s full-year total. This boom reflects a structural imbalance: demand for liquidity among LPs far outstrips available secondary capital, as many investors seek to adjust exposures amid slower exits and macro uncertainty. We expect this supply-demand gap to persist, creating a favorable environment for secondary fund managers and buyers with dry powder. Notably, GP-led secondaries (such as continuation funds) are becoming mainstream, with sponsors using them to give investors optional liquidity while retaining ownership of prized assets. In our view, providing liquidity when and where it is scarce can command premium returns essentially turning the liquidity constraint into an investment advantage. Over the next few years, we anticipate secondary strategies will be an integral part of portfolio management for LPs, not only for opportunistic purchases of discounted stakes but also as a routine tool for active rebalancing. The secondary market’s maturation is an enduring shift toward more flexible private market portfolios, and it remains underutilized by many institutions – suggesting room for further growth as acceptance rises.

Each of these secular themes reflects enduring, structural shifts in the alternatives arena that were not front-and-center in early 2025. They highlight areas of innovation (e.g. blockchain and tokenization in finance), structural demand (e.g. for supply chain resilience, or for liquidity solutions), and regulatory or market developments that are opening new entry points for investors. Importantly, these are not short-lived fads, but long-horizon currents around which institutional strategies can be oriented. As we conclude this outlook, we emphasize maintaining a forward-looking and adaptable approach: by steadily calibrating portfolios toward these emerging opportunities while still exercising due diligence and patience, investors can position themselves to harvest the next generation of alternative investment returns. This strategic recalibration towards nascent secular themes, in our opinion, will distinguish the allocators who successfully navigate the coming years from those who simply react to yesterday’s playbook.

Conclusion

Key Takeaways for LPs: As we synthesize the mid-2025 outlook across these themes, a few overarching principles emerge. First, thematic positioning in alternatives should tilt toward areas underpinned by structural growth while retaining diversification for resilience. The past six months have reinforced the wisdom of our core themes: AI and digital infrastructure remain engines of innovation and return potential; infrastructure provides a backbone of stability and inflation protection; hedge funds contribute agility and downside mitigation in a volatile regime; GP stakes capitalize on the very growth of the alternatives industry; and real estate (selectively chosen) offers income and appreciation tied to human and business needs. LPs should ensure their portfolios have exposure to each of these broad opportunity sets, calibrated to their risk/return objectives. The unifying idea is to align investments with structural trends such as digitalization, energy transition, and the shifting future-of-work because we believe they should drive asset appreciation over the long term more than short-term cyclical moves.

Positioning for the Future: In conclusion, investors should come away from this mid-2025 outlook with confidence in the fundamental themes driving alternative investments, but also with a clear plan for balancing opportunity and risk. AI and digital infrastructure offer transformational growth but require power, caution and patience. Core infrastructure provides yield and stability but one must still choose wisely among sub-sectors and be mindful of policy risks. Hedge funds can deliver uncorrelated returns but picking skilled managers and allocating dynamically are materially important. GP stakes let you participate in the growth of the alternative industry itself, aligning with top managers but they demand a long view and strong due diligence. Real estate can once again produce steady income and appreciation but only if you pivot away from obsolete assets and toward the future of living, working, and logistics.

For the second half of 2025 and into 2026, we recommend investors stay the course on their strategic allocations to alternatives, with these themes as guideposts, and fine-tune at the margins based on the mid-year developments discussed. Ensure liquidity is managed so you can both withstand any shocks and offensively deploy when markets misprice assets. Keep an eye on the macro dashboard: inflation, rates, growth, geopolitical events as the signals there will inform which alternative strategies to emphasize at any given time. By aligning investments with the powerful secular trends (technology, sustainability, demographic shifts) and by remaining disciplined yet flexible, institutional investors can navigate the complexities of today’s environment. The year 2025 is unfolding as a period of resilience and innovation in alternatives, and those investors who position thoughtfully now will hopefully be rewarded with portfolios capable of weathering economic variability and capitalizing on the next wave of opportunities. In other words, build your portfolio for the long term, but always be ready to adapt in the short term. That is the balancing act of alternative investing in 2025, and we trust that this outlook provides a useful roadmap for executing it.

References:

2025 Global Data Center Outlook

https://www.jll.com/en-us/insights/data-center-outlook

EIA projects record US data center power use amid AI and crypto boom - DCD

https://www.datacenterdynamics.com/en/news/eia-projects-record-us-data-center-power-use-amid-ai-and-crypto-boom/

Alternative Investment Outlook: Opportunities for 2025 and Beyond — Elyxium Wealth

https://www.elyxwealth.com/insights/alternative-investment-outlook-opportunities-for-2025-and-beyond

Infrastructure in 2025: the outlook for fundraising, deals, and ... - Preqin

https://www.preqin.com/news/infrastructure-in-2025-the-outlook-for-fundraising-deals-and-performance

Calculated Risk: "The Office Sector’s Double Whammy"; Record High Office Vacancy Rate

https://www.calculatedriskblog.com/2025/07/the-office-sectors-double-whammy-record.html

How Many U.S. Offices Are Empty? - Voronoi

https://www.voronoiapp.com/real-estate/How-Many-US-Offices-Are-Empty-1760

Todd N. Golper is a CERTIFIED FINANCIAL PLANNER™ CERTIFIED PRIVATE WEALTH ADVISOR™, Head of Strategy and Alternative Investments of Elyxium Wealth, LLC, a Registered Investment Adviser that offers comprehensive financial planning, retirement planning, and investment management.

Elyxium Wealth LLC (“the FIRM ”) is a registered investment adviser located in Beverly Hills, California. The FIRM may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

Past performance is not indicative of future performance. Therefore, no current or prospective client should assume that future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the FIRM), or product referenced directly or indirectly in this presentation, will be profitable. Different types of investments involve varying degrees of risk, & there can be no assurance that any specific investment or investment strategy will be suitable for a client’s or prospective client’s portfolio.

The foregoing content reflects the opinions of Elyxium Wealth, LLC and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice, financial advice, tax advice, or legal advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions, or forecasts provided herein will prove to be correct. The above article was written with the assistance of artificial intelligence (AI).

INV-250730