The Deficit and Its Impact on Stock Market Returns and Interest Rates

A government budget deficit arises when expenditures exceed revenues over a specified period, typically a fiscal year. This gap is financed through borrowing, most often by issuing government bonds. In the United States, persistent deficits have led to a growing national debt, sparking debates as the debt has grown through the years. Many times in the recent past, interest rates were near zero (ZIRP), and interest payments were low. Post Covid-19, with inflation returning and the Federal Reserve raising rates to combat it, our deficits have once again become a concern. Two areas of particular focus are the effects of deficits on stock market returns and interest rates—key indicators of economic performance and investor sentiment. While conventional economic theory offers some predictive power in understanding these relationships, real-world outcomes are shaped by complex interactions between monetary policy, investor behavior, and global capital markets.

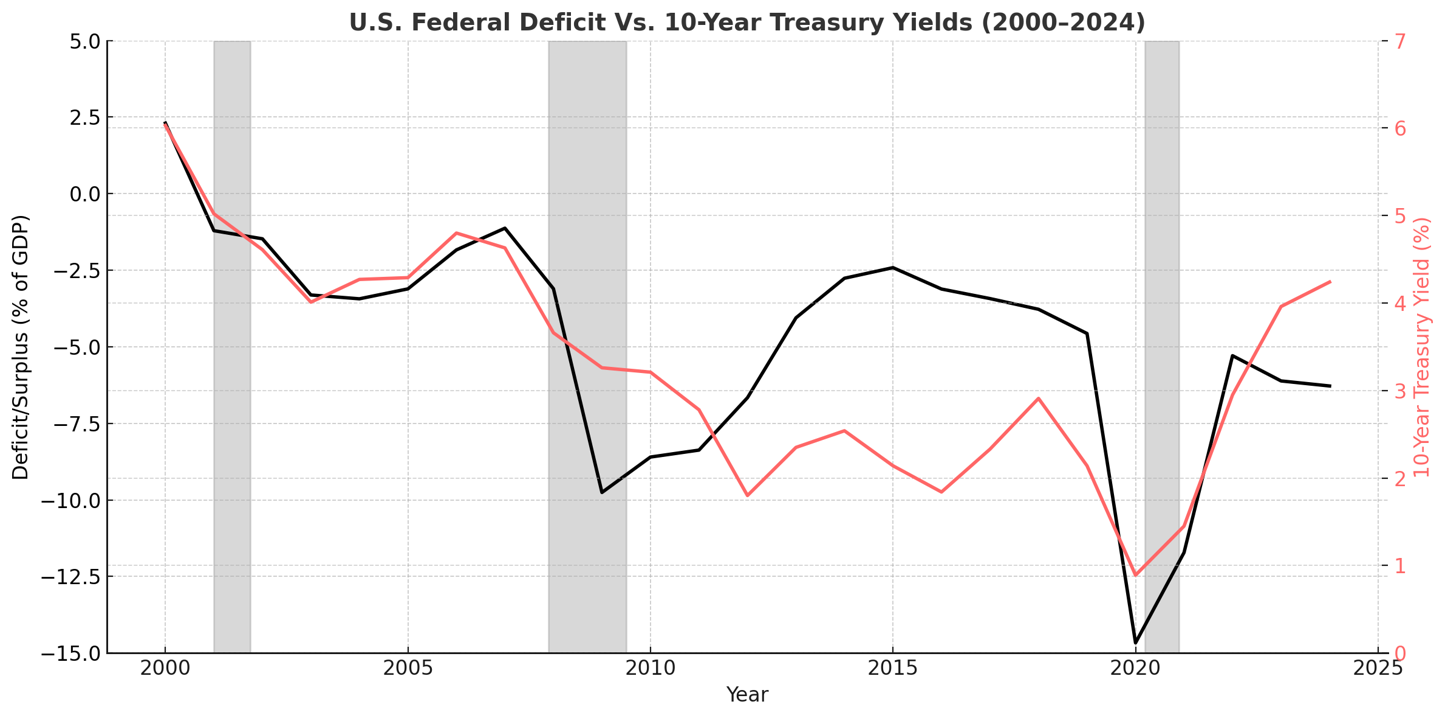

The Link Between Deficits and Interest Rates

One of the most direct and frequently discussed effects of a budget deficit is on interest rates. The traditional view holds that higher deficits lead to increased government borrowing, which raises the demand for loanable funds. If the supply of savings is held constant, the increased demand pushes interest rates higher. Higher interest rates, in turn, can crowd out private investment by making borrowing more expensive for businesses and consumers.

However, the empirical evidence on this relationship is mixed. In some periods, such as the 1980s in the U.S., large deficits coincided with high interest rates, seemingly supporting the traditional view. Yet in the aftermath of the 2008 financial crisis and the COVID-19 pandemic, massive fiscal deficits were accompanied by historically low interest rates. This suggests that other factors, particularly monetary policy and global demand for safe assets, can offset or override the effects of deficits.

Central banks play a crucial role in mediating this relationship. When a central bank, like the Federal Reserve, purchases government securities through quantitative easing, it can help keep interest rates low even amid large deficits. Additionally, in a globally integrated financial system, the U.S. can attract foreign capital to finance its deficits without immediately driving up interest rates, thanks to the dollar’s role as the world’s reserve currency.

Nonetheless, persistent and growing deficits may eventually exert upward pressure on long-term interest rates. Investors may demand a higher risk premium to hold government debt if they perceive increased risk of inflation or fiscal instability. This is particularly true if deficits are seen as unsustainable or if political gridlock undermines confidence in the government's ability to manage its finances.

Over the past 25 years, and since the last time we balanced our annual budget under President Clinton, interest rates have been both high and low, as noted above. While an investor may therefore downplay deficits, we believe that would be a mistake. It is the breaking point, marked by a bond market that demands higher rates because of poor government practices that markets should eventually fear. Strategist Ed Yardeni is famous for his comments regarding “bond vigilantes” made in the 1980s when interest rates were soaring because of high inflation and rising energy prices. Bond investors, he claimed, were selling bonds in protest of poor fiscal and monetary policy. While we don’t see that happening today, we must be on the lookout for their reappearance.

Sources: U.S. Department of the Treasury: Fiscal Service via FRED, Yahoo Finance

The Impact of Deficits on Stock Market Returns

The relationship between deficits and stock market returns is complex and mediated by several factors. At a basic level, higher interest rates—potentially caused by deficit-financed spending—can be detrimental to stock prices. This is because higher rates increase the discount rate used in valuing future corporate earnings, leading to lower present values for stocks. Additionally, higher borrowing costs can reduce corporate profits and slow down economic growth, both of which negatively impact stock market performance.

However, the story is not entirely negative. Deficit spending, especially during recessions, can support economic growth by stimulating demand. This, in turn, can lead to higher corporate earnings and stronger stock market performance. In the short term, fiscal stimulus—often accompanied by budget deficits—can boost investor confidence and asset prices.

This is a key factor to remember: in the short run, deficits are a stimulant to the economy and for asset prices. While the bill will eventually become due, in the near term, investors have been rewarded for staying invested.

A good example is the market response to stimulus packages during the COVID-19 pandemic. Despite record-breaking deficits, stock markets rebounded quickly and reached new highs, driven in part by government support for households and businesses, along with accommodative monetary policy.

Moreover, investor expectations play a crucial role. If deficits are expected to result in productive public investments—in infrastructure, education, or technology—they may be seen as growth-enhancing, supporting equity valuations. On the other hand, if deficits are perceived as wasteful or unsustainable, they may trigger fears of inflation, higher taxes, or future financial crises—all of which can weigh on equity markets.

Inflation Expectations and Fiscal Credibility

Another important channel through which deficits influence interest rates and stock markets is inflation expectations. If investors believe that persistent deficits will ultimately be monetized (i.e., financed by central bank money creation), they may expect higher inflation in the future. This can push up nominal interest rates and depress real returns on both bonds and equities.

Fiscal credibility—defined as the belief that the government will eventually stabilize debt levels—is crucial in maintaining low borrowing costs and market stability. Countries with strong institutions and transparent policy frameworks are often able to run larger deficits without facing immediate market backlash. In contrast, countries with weak fiscal governance may face sharp increases in borrowing costs or currency depreciation when running high deficits. The US must take steps to maintain its credibility in the face of rising debt levels. Showing a path to more modest use of debt and/or showing a path of economic growth will be critical in the years ahead.

Long-Term Risks and Policy Trade-offs

Over the long term, persistent deficits can pose risks to both interest rates and stock markets. Rising debt levels may limit the government’s ability to respond to future crises, constrain fiscal policy options, and increase the burden of interest payments, especially if rates are relatively high. This could lead to a crowding out of public investment or require higher taxes, which can dampen economic growth.

For investors, this introduces a level of policy risk that could affect long-term equity valuations. For example, if growing deficits prompt future tax increases on capital gains or corporate income, this could negatively impact stock prices. Similarly, if interest payments begin to consume a large share of the federal budget, investors may worry about the government's ability to fund other priorities, including economic development and innovation.

Sources: U.S. Department of the Treasury

The chart above shows the interest payments on the U.S. deficit through the fiscal year to date.

Conclusion

The impact of budget deficits on stock market returns and interest rates is shaped by a dynamic interplay of economic forces and policy decisions. While traditional theory predicts that deficits lead to higher interest rates and lower equity valuations, real-world outcomes often depend on context—such as the stage of the economic cycle, the stance of monetary policy, global capital flows, and investor sentiment.

While we have analyzed deficit long-term implications, so far we have not allowed the level of deficits to influence our allocation decisions. For the last 40 years, the economic growth and strength of the US reputation have outshined the negatives of deficit spending. We will continue to monitor this topic, knowing that someday markets will demand more government responsibility. You can count on us to take appropriate action at that time.

In the short term, deficits can support economic activity and bolster financial markets, especially when used countercyclically. However, over the long term, unsustainable deficits may pose risks to interest rate stability, inflation control, and market confidence. For policymakers and investors alike, the key is to strike a balance between fiscal stimulus and sustainability, ensuring that short-term support does not come at the expense of long-term stability.

Elyxium Wealth LLC (“the FIRM ”) is a registered investment adviser located in Beverly Hills, California. The FIRM may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This presentation is limited to the dissemination of general information regarding the FIRM’s investment advisory services. Accordingly, the information in this presentation should not be construed, in any manner whatsoever, as a substitute for personalized individual advice from the FIRM. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Any client examples were hypothetical and used to demonstrate a concept.

Past performance is not indicative of future performance. Therefore, no current or prospective client should assume that future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended by the FIRM), or product referenced directly or indirectly in this presentation, will be profitable. Different types of investments involve varying degrees of risk, & there can be no assurance that any specific investment or investment strategy will suitable for a client’s or prospective client’s investment portfolio.

INV-250729